Cheapest Car Insurance in Arizona (2026)

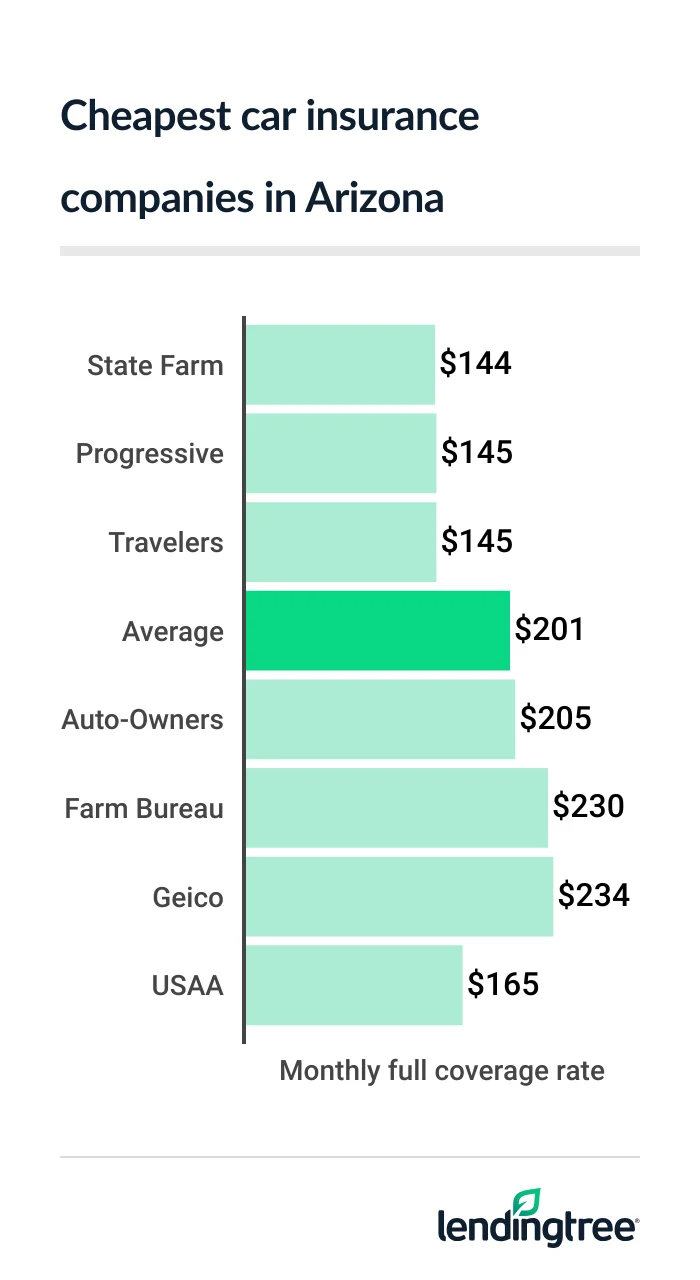

State Farm has Arizona’s cheapest full coverage car insurance at $144 a month. This is $57 cheaper than the state average of $201 a month.

Best cheap car insurance in Arizona

Arizona’s cheapest full coverage car insurance: State Farm

State Farm has the cheapest full coverage car insurance in Arizona at $144 a month. This is barely less than the next-cheapest rate of $145 a month from both Progressive and Travelers.

Among State Farm, Progressive, and Travelers, State Farm has the best satisfaction rating from J.D. Power.

Full coverage auto insurance rates

| Company | Monthly rate | LendingTree score | |

|---|---|---|---|

| State Farm | $144 |  |

| Progressive | $145 | |

| Travelers | $145 |  |

| Auto-Owners | $205 |  |

| Farm Bureau | $230 | |

| Geico | $234 | |

| The Hartford | $257 | |

| Allstate | $283 | |

| USAA* | $165 | |

Full coverage

Each company treats these factors differently and offers different car insurance discounts. It’s good to compare car insurance quotes from multiple companies to find the cheapest rate.

Cheap Arizona liability insurance: State Farm

At $56 a month, State Farm has the cheapest liability insurance for most Arizona drivers. USAA is slightly cheaper, but it’s only available to the military community. Travelers has the next-cheapest liability

Liability auto insurance rates by company

| Company | Monthly rate |

|---|---|

| State Farm | $56 |

| Travelers | $62 |

| Progressive | $82 |

| Auto-Owners | $84 |

| Farm Bureau | $85 |

| The Hartford | $100 |

| Geico | $107 |

| Allstate | $110 |

| USAA* | $55 |

Travelers offers a few discounts that State Farm doesn’t have. These include a discount for driving a new car and another for driving a hybrid or electric vehicle. It also gives you a discount for getting a quote before your current policy expires. If you qualify, these could make Travelers a better deal for you than State Farm.

Best car insurance rates for Arizona teens: Travelers

Travelers has the cheapest car insurance for teens in Arizona. It charges young drivers $175 a month for liability insurance and $374 a month for full coverage. State Farm has the next-cheapest rates at $193 a month for liability and $427 a month for full coverage.

Young driver auto insurance rates

| Company | Liability coverage | Full coverage |

|---|---|---|

| Travelers | $175 | $374 |

| State Farm | $193 | $427 |

| The Hartford | $240 | $714 |

| Farm Bureau | $259 | $587 |

| Geico | $269 | $515 |

| Progressive | $283 | $576 |

| Auto-Owners | $284 | $578 |

| Allstate | $311 | $786 |

| USAA* | $157 | $418 |

A lack of driving experience makes teens more likely to crash than older drivers. This is the main reason why they get charged so much for car insurance. Young drivers can often get car insurance discounts for:

- Getting good grades

- Completing a driver training program

- Going off to college without a car

Usage-based car insurance (UBI) programs can also help teens save on car insurance. Most major companies, including State Farm, Travelers and Progressive, have them. Most use an app to monitor how safely you drive. You get discounts

These programs are open to drivers of any age, but teens may benefit the most. Along with a discount, the apps give feedback that can help improve your driving skills.

Cheapest AZ car insurance after a speeding ticket: State Farm

Arizona drivers with a speeding ticket can get the cheapest car insurance quotes from State Farm. The company charges drivers with a ticket $153 a month for full coverage. This is 16% less than the next-cheapest rate of $183 a month from Travelers.

Insurance rates with a speeding ticket

| Company | Monthly rate |

|---|---|

| State Farm | $153 |

| Travelers | $183 |

| Progressive | $195 |

| Auto-Owners | $205 |

| Farm Bureau | $312 |

| Geico | $313 |

| The Hartford | $341 |

| Allstate | $412 |

| USAA* | $213 |

Best Arizona car insurance rates with an accident: State Farm

At $144 a month, State Farm has Arizona’s cheapest car insurance after an at-fault accident. Travelers has the next-cheapest rate at $204 a month.

An accident raises the average cost of car insurance in Arizona by 45% to $291 a month. However, you may find a cheaper rate if you shop around. This makes it especially important to compare quotes if you have a bad driving record.

Auto insurance rates after an accident

| Company | Monthly rate |

|---|---|

| State Farm | $144 |

| Travelers | $204 |

| Progressive | $212 |

| Geico | $256 |

| Auto-Owners | $283 |

| The Hartford | $395 |

| Farm Bureau | $437 |

| Allstate | $448 |

| USAA* | $244 |

Best for Arizona teens with a ticket or accident: State Farm

State Farm has the best car insurance rates for Arizona teens with bad driving records. The company’s liability rates average $209 a month for young drivers with a speeding ticket. Its rates average $193 a month after an accident.

Travelers’ rates for teens with a ticket are only slightly more expensive at $219 a month. However, its rates for teens with an accident average $258 a month. This is 33% higher than State Farm’s rate.

Insurance rates for bad teen drivers

| Company | Ticket | Accident |

|---|---|---|

| State Farm | $209 | $193 |

| Travelers | $219 | $258 |

| Auto-Owners | $284 | $440 |

| Progressive | $307 | $315 |

| The Hartford | $325 | $422 |

| Geico | $353 | $279 |

| Allstate | $358 | $411 |

| Farm Bureau | $359 | $518 |

| USAA* | $254 | $279 |

Cheapest AZ car insurance after a DUI: Progressive

Progressive has Arizona’s cheapest DUI insurance quotes. The company charges drivers with a DUI (driving under the influence) $184 a month. This is 13% less than the next-cheapest rate of $212 a month from Travelers.

DUI car insurance rates

| Company | Monthly rate |

|---|---|

| Progressive | $184 |

| Travelers | $212 |

| State Farm | $272 |

| Auto-Owners | $362 |

| The Hartford | $390 |

| Geico | $411 |

| Allstate | $456 |

| Farm Bureau | $557 |

| USAA* | $325 |

Arizona’s cheapest bad credit car insurance: Travelers

Travelers has Arizona’s cheapest bad credit car insurance at $223 a month. This is 47% less than the average rate of $420 a month for Arizona drivers with bad credit.

At $226 a month, Progressive is only slightly more expensive than Travelers for drivers with bad credit.

Insurance rates with bad credit

| Company | Monthly rate |

|---|---|

| Travelers | $223 |

| Progressive | $226 |

| Geico | $356 |

| Farm Bureau | $395 |

| Allstate | $399 |

| The Hartford | $471 |

| Auto-Owners | $595 |

| State Farm | $788 |

| USAA* | $329 |

Insurance companies check your credit for things like your payment history and borrowing amounts. Avoiding late payments and paying down debts can help you get lower car insurance rates in the future.

Best car insurance companies in Arizona

State Farm and Travelers are the best car insurance companies in Arizona for different reasons.

State Farm stands out for low rates and a good customer satisfaction score. Its high satisfaction rating means customers generally like its combination of price, coverage and service.

Travelers stands out for its low rates and flexible coverage options. It offers gap insurance

Insurance company ratings

| Company | LendingTree score | J.D. Power | AM Best |

|---|---|---|---|

| Auto-Owners | 4.8 | 638 | A+ |

| State Farm | 4.5 | 650 | A++ |

| Travelers | 4.4 | 613 | A++ |

| Farm Bureau | 4.0 | 645 | A |

| Progressive | 3.8 | 621 | A+ |

| Geico | 3.7 | 645 | A++ |

| Allstate | 3.2 | 635 | A+ |

| The Hartford | 1.9 | 632 | A+ |

| USAA* | 4.1 | 735 | A++ |

Most new car forgiveness programs only last one or two years. Travelers’ program lasts up to five years. You only need to pay your deductible to get a new version of your car if it’s totaled during this time.

Of the two companies, State Farm has a better UBI program. Each company gives you a big discount for driving safely with its UBI app. However, Travelers may raise your rate if its app detects unsafe driving. State Farm’s program doesn’t raise your rate for bad driving.

Arizona car insurance rates by city

Lake Havasu City and Desert Hills tie for Arizona’s cheapest car insurance by location. Drivers in both areas pay an average of $147 a month, which is 27% less than the state average. Dolan Springs has the next-cheapest rate at $149 a month.

Phoenix has the state’s most expensive car insurance at $238 a month. This is 18% higher than the state average. Glendale drivers have the next-highest rate at $229 a month.

Car insurance rates near you

| City | Monthly rate | City vs. state average |

|---|---|---|

| Aguila | $194 | -4% |

| Ajo | $175 | -13% |

| Ak-Chin Village | $184 | -8% |

| Alpine | $161 | -20% |

| Amado | $162 | -19% |

| Anthem | $200 | 0% |

| Apache Junction | $191 | -5% |

| Arizona City | $178 | -11% |

| Arizona Village | $153 | -24% |

| Arlington | $189 | -6% |

| Avenue B and C | $170 | -15% |

| Avondale | $216 | 8% |

| Avra Valley | $177 | -12% |

| Bagdad | $158 | -21% |

| Bapchule | $184 | -8% |

| Bellemont | $161 | -20% |

| Benson | $161 | -20% |

| Bisbee | $155 | -23% |

| Black Canyon City | $173 | -14% |

| Blackwater | $180 | -10% |

| Blue | $162 | -19% |

| Blue Gap | $177 | -12% |

| Bluewater | $156 | -22% |

| Bouse | $160 | -20% |

| Buckeye | $191 | -5% |

| Bullhead City | $155 | -23% |

| Bylas | $158 | -21% |

| Cactus Flats | $152 | -24% |

| Cameron | $176 | -12% |

| Camp Verde | $162 | -19% |

| Carefree | $197 | -2% |

| Casa Grande | $175 | -13% |

| Casas Adobes | $184 | -8% |

| Cashion | $207 | 3% |

| Catalina | $169 | -16% |

| Catalina Foothills | $188 | -6% |

| Cave Creek | $201 | 0% |

| Central | $165 | -18% |

| Central Heights-Midland City | $170 | -15% |

| Chambers | $174 | -13% |

| Chandler | $198 | -1% |

| Chandler Heights | $193 | -4% |

| Chinle | $179 | -11% |

| Chino Valley | $161 | -20% |

| Chloride | $159 | -21% |

| Cibecue | $178 | -11% |

| Cibola | $160 | -20% |

| Cienega Springs | $157 | -22% |

| Citrus Park | $201 | 0% |

| Clarkdale | $160 | -20% |

| Clay Springs | $177 | -12% |

| Claypool | $170 | -15% |

| Clifton | $155 | -23% |

| Cochise | $157 | -22% |

| Colorado City | $164 | -18% |

| Concho | $167 | -17% |

| Congress | $162 | -19% |

| Coolidge | $180 | -10% |

| Cordes Lakes | $163 | -19% |

| Cornville | $160 | -20% |

| Corona De Tucson | $177 | -12% |

| Cortaro | $187 | -7% |

| Cottonwood | $160 | -20% |

| Crown King | $167 | -17% |

| Dateland | $183 | -9% |

| Desert Hills | $147 | -27% |

| Dewey | $163 | -19% |

| Dilkon | $165 | -18% |

| Dolan Springs | $149 | -26% |

| Doney Park | $161 | -20% |

| Donovan Estates | $169 | -16% |

| Douglas | $156 | -22% |

| Dragoon | $157 | -22% |

| Drexel Heights | $192 | -4% |

| Dudleyville | $171 | -15% |

| Duncan | $155 | -23% |

| Eagar | $165 | -18% |

| Eden | $156 | -22% |

| Ehrenberg | $165 | -18% |

| El Mirage | $202 | 1% |

| Elfrida | $154 | -23% |

| Elgin | $163 | -19% |

| Eloy | $179 | -11% |

| Flagstaff | $162 | -19% |

| Florence | $183 | -9% |

| Flowing Wells | $193 | -4% |

| Forest Lakes | $164 | -18% |

| Fort Apache | $180 | -10% |

| Fort Defiance | $183 | -9% |

| Fort Huachuca | $152 | -24% |

| Fort Mcdowell | $182 | -9% |

| Fort Mohave | $154 | -23% |

| Fort Thomas | $166 | -17% |

| Fort Valley | $160 | -20% |

| Fortuna Foothills | $161 | -20% |

| Fountain Hills | $186 | -8% |

| Fredonia | $160 | -20% |

| Gadsden | $173 | -14% |

| Ganado | $175 | -13% |

| Gila Bend | $189 | -6% |

| Gilbert | $200 | -1% |

| Glendale | $229 | 14% |

| Globe | $170 | -15% |

| Gold Canyon | $189 | -6% |

| Golden Valley | $154 | -23% |

| Goodyear | $192 | -4% |

| Grand Canyon | $164 | -18% |

| Gray Mountain | $176 | -12% |

| Greasewood | $169 | -16% |

| Green Valley | $155 | -23% |

| Greer | $167 | -17% |

| Guadalupe | $206 | 3% |

| Hackberry | $154 | -23% |

| Happy Jack | $161 | -20% |

| Hayden | $177 | -12% |

| Heber | $166 | -17% |

| Hereford | $151 | -25% |

| Higley | $200 | 0% |

| Holbrook | $164 | -18% |

| Hotevilla | $174 | -13% |

| Houck | $184 | -8% |

| Huachuca City | $153 | -24% |

| Hualapai | $163 | -19% |

| Humboldt | $170 | -15% |

| Hunter Creek | $167 | -17% |

| Icehouse Canyon | $169 | -16% |

| Jerome | $161 | -20% |

| Joseph City | $172 | -14% |

| Kachina Village | $160 | -20% |

| Kaibeto | $165 | -18% |

| Kaka | $174 | -13% |

| Kayenta | $175 | -13% |

| Keams Canyon | $172 | -14% |

| Kearny | $173 | -14% |

| Kingman | $152 | -24% |

| Kirkland | $163 | -19% |

| Kykotsmovi Village | $171 | -15% |

| Lake Havasu City | $147 | -27% |

| Lake Montezuma | $173 | -14% |

| Lakeside | $167 | -17% |

| Laveen | $222 | 10% |

| Leupp | $165 | -18% |

| Linden | $168 | -16% |

| Litchfield Park | $200 | 0% |

| Littlefield | $153 | -24% |

| Low Mountain | $173 | -14% |

| Lower Santan Village | $182 | -9% |

| Lukachukai | $183 | -9% |

| Luke AFB | $201 | 0% |

| Lukeville | $186 | -7% |

| Lupton | $184 | -8% |

| Mammoth | $178 | -11% |

| Many Farms | $186 | -7% |

| Marana | $182 | -9% |

| Marble Canyon | $161 | -20% |

| Maricopa | $182 | -9% |

| Mayer | $163 | -19% |

| McNeal | $155 | -23% |

| McNary | $177 | -12% |

| Meadview | $151 | -25% |

| Mesa | $203 | 1% |

| Mescal | $161 | -20% |

| Miami | $170 | -15% |

| Moenkopi | $169 | -16% |

| Mohave Valley | $153 | -24% |

| Morenci | $154 | -23% |

| Mormon Lake | $164 | -18% |

| Morristown | $183 | -9% |

| Mount Lemmon | $175 | -13% |

| Mountainaire | $160 | -20% |

| Munds Park | $162 | -19% |

| Naco | $176 | -13% |

| Nazlini | $178 | -11% |

| New Kingman-Butler | $154 | -23% |

| New River | $200 | 0% |

| Nogales | $171 | -15% |

| North Rim | $162 | -19% |

| Nutrioso | $175 | -13% |

| Oatman | $155 | -23% |

| Oracle | $170 | -15% |

| Oro Valley | $175 | -13% |

| Overgaard | $167 | -17% |

| Page | $162 | -19% |

| Palo Verde | $194 | -3% |

| Paradise Valley | $207 | 3% |

| Parker | $157 | -22% |

| Parker Strip | $156 | -22% |

| Parks | $161 | -20% |

| Patagonia | $162 | -19% |

| Paulden | $163 | -19% |

| Payson | $168 | -16% |

| Peach Springs | $159 | -21% |

| Pearce | $156 | -22% |

| Peoria | $204 | 1% |

| Peridot | $170 | -15% |

| Petrified Forest National Park | $183 | -9% |

| Phoenix | $238 | 18% |

| Picacho | $180 | -11% |

| Picture Rocks | $182 | -9% |

| Pima | $154 | -23% |

| Pine | $162 | -19% |

| Pinedale | $169 | -16% |

| Pinetop | $165 | -18% |

| Pirtleville | $169 | -16% |

| Polacca | $170 | -15% |

| Pomerene | $162 | -19% |

| Portal | $155 | -23% |

| Poston | $180 | -10% |

| Prescott | $161 | -20% |

| Prescott Valley | $160 | -21% |

| Quartzsite | $159 | -21% |

| Queen Creek | $196 | -2% |

| Rainbow City | $171 | -15% |

| Red Rock | $183 | -9% |

| Red Valley | $187 | -7% |

| Rillito | $180 | -10% |

| Rimrock | $162 | -19% |

| Rincon Valley | $183 | -9% |

| Rio Rico | $168 | -16% |

| Rio Verde | $187 | -7% |

| Rock Point | $188 | -6% |

| Roll | $173 | -14% |

| Roosevelt | $170 | -15% |

| Round Rock | $188 | -7% |

| Sacaton | $185 | -8% |

| Saddlebrooke | $166 | -17% |

| Safford | $153 | -24% |

| Sahuarita | $161 | -20% |

| Salome | $171 | -15% |

| San Carlos | $168 | -16% |

| San Luis | $171 | -15% |

| San Manuel | $174 | -13% |

| San Simon | $155 | -23% |

| San Tan Valley | $195 | -3% |

| Sanders | $184 | -8% |

| Sasabe | $182 | -9% |

| Sawmill | $183 | -9% |

| Scottsdale | $202 | 1% |

| Second Mesa | $170 | -15% |

| Sedona | $165 | -18% |

| Seligman | $157 | -22% |

| Sells | $188 | -6% |

| Shonto | $172 | -14% |

| Show Low | $168 | -16% |

| Sierra Vista | $152 | -24% |

| Sierra Vista Southeast | $151 | -25% |

| Skull Valley | $171 | -15% |

| Snowflake | $168 | -16% |

| Solomon | $168 | -16% |

| Somerton | $168 | -16% |

| Sonoita | $166 | -17% |

| South Tucson | $195 | -3% |

| Springerville | $166 | -17% |

| St. David | $160 | -20% |

| St. Johns | $167 | -17% |

| St. Michaels | $173 | -14% |

| Stanfield | $178 | -11% |

| Strawberry | $162 | -19% |

| Summit | $191 | -5% |

| Sun City | $184 | -8% |

| Sun City West | $171 | -15% |

| Sun Lakes | $186 | -7% |

| Sun Valley | $177 | -12% |

| Supai | $161 | -20% |

| Superior | $184 | -9% |

| Surprise | $188 | -6% |

| Swift Trail Junction | $153 | -24% |

| Tacna | $184 | -8% |

| Tanque Verde | $181 | -10% |

| Taylor | $169 | -16% |

| Teec Nos Pos | $177 | -12% |

| Tempe | $207 | 3% |

| Temple Bar Marina | $156 | -22% |

| Thatcher | $153 | -24% |

| Tolleson | $228 | 14% |

| Tombstone | $153 | -24% |

| Tonalea | $171 | -15% |

| Tonopah | $189 | -6% |

| Tonto Basin | $170 | -15% |

| Topawa | $192 | -4% |

| Topock | $151 | -25% |

| Tortilla Flat | $190 | -5% |

| Tsaile | $179 | -11% |

| Tuba City | $168 | -16% |

| Tubac | $171 | -15% |

| Tucson | $191 | -5% |

| Tucson Estates | $195 | -3% |

| Tumacacori | $163 | -19% |

| Turkey Creek | $171 | -15% |

| Vail | $177 | -12% |

| Valencia West | $191 | -5% |

| Valentine | $160 | -20% |

| Valle Vista | $151 | -25% |

| Valley Farms | $181 | -10% |

| Verde Village | $160 | -20% |

| Vernon | $179 | -11% |

| Vicksburg | $171 | -15% |

| Waddell | $198 | -1% |

| Wall Lane | $163 | -19% |

| Wellton | $167 | -17% |

| Wenden | $174 | -13% |

| Whetstone | $153 | -24% |

| White Hills | $152 | -24% |

| White Mountain Lake | $168 | -16% |

| Whitecone | $171 | -15% |

| Whiteriver | $171 | -15% |

| Wickenburg | $170 | -15% |

| Wikieup | $163 | -19% |

| Willcox | $155 | -23% |

| Williams | $162 | -19% |

| Williamson | $160 | -20% |

| Willow Beach | $152 | -24% |

| Willow Valley | $153 | -24% |

| Window Rock | $182 | -9% |

| Winslow | $165 | -18% |

| Winslow West | $165 | -18% |

| Wittmann | $182 | -9% |

| Woodruff | $170 | -15% |

| Yarnell | $164 | -18% |

| Young | $164 | -19% |

| Youngtown | $196 | -2% |

| Yucca | $163 | -19% |

| Yuma | $168 | -16% |

Best and worst drivers in Arizona

Yuma has the best drivers in Arizona, according to LendingTree research. Buckeye has the state’s worst drivers.

Also, older Arizonans are better drivers than younger ones. Of the different age groups, Generation Z gets into the most traffic incidents in Arizona by a wide margin. The silent generation gets into the fewest.

Arizona metros with the best and worst drivers

Among the largest metro areas in Arizona, Yuma has the fewest car-related incidents. It has an incident rate of 13.1 per 1,000 drivers, while second-place Avondale is at 13.2. Casa Grande comes in third, with a 14.2 incident rate.

Best drivers by city

| City | Incidents per 1,000 drivers |

|---|---|

| Yuma | 13.1 |

| Avondale | 13.2 |

| Casa Grande | 14.2 |

| Glendale | 14.6 |

| San Tan Valley | 14.6 |

The Arizona metro or city with the most car-related incidents is Buckeye, at 25.5 per 1,000 drivers. Prescott Valley is the next, with an incident rate of 24.6 per 1,000 drivers.

Worst drivers by city

| City | Incidents per 1,000 drivers |

|---|---|

| Buckeye | 25.5 |

| Prescott Valley | 24.6 |

| Queen Creek | 24.4 |

| Maricopa | 19.5 |

| Scottsdale | 19.2 |

Best and worst drivers by age group

The worst drivers in Arizona by age group come from Gen Z. It has the state’s highest rate of traffic incidents, at 54.9 per 1,000 drivers.

Millennials come in second, though this generation’s rate is 27.4 per 1,000 drivers — which is half the Gen Z rate.

Worst drivers by generation

| Generation | Incidents per 1,000 drivers |

|---|---|

| Gen Z | 54.9 |

| Millennial | 27.4 |

| Gen X | 21.0 |

| Boomer | 17.1 |

| Silent generation | 15.2 |

Best and worst drivers by car make

Saturn drivers are the best in Arizona, with an incident rate of 12.42 per 1,000 drivers. Mercury drivers are close behind, though, with a 12.74 incident rate.

Best drivers by car make

| Make | Incidents per 1,000 drivers |

|---|---|

| Saturn | 12.42 |

| Mercury | 12.74 |

| Pontiac | 14.10 |

| Chrysler | 16.71 |

| Cadillac | 17.51 |

Teslas are involved in more traffic incidents than any other car brand in Arizona. Its incident rate is 35.73 per 1,000 drivers. Volkswagen, in second, has a 31.02 incident rate.

Worst drivers by car make

| Make | Incidents per 1,000 drivers |

|---|---|

| Tesla | 35.73 |

| Volkswagen | 31.02 |

| Ram | 29.13 |

| Volvo | 29.06 |

| Mazda | 28.96 |

Arizona auto insurance requirements

Auto insurance is required by law in Arizona. The state’s minimum car insurance requirements include:

-

Bodily injury liability

: $25,000 per injured person, $50,000 per accidentBodily injury liability helps cover the medical bills of other people you injure in a car accident.

-

Property damage liability

: $15,000Property damage liability covers damage you cause to property like fences, toll booths and light posts.

If you have a car loan, your lender will make you add collision

Most car insurance companies also offer uninsured motorist

Frequently asked questions

The average cost of car insurance in Arizona is $201 a month for full coverage. Minimum coverage, or liability-only insurance, costs $82 a month. Rates also tend to be higher in the Phoenix area than they are in places with fewer people.

State Farm, Progressive and Travelers have the cheapest car insurance for most Arizona drivers. Minimum coverage policies are cheaper than full coverage. However, these don’t cover your injuries or damage to your vehicle.

Car insurance is required to drive legally in Arizona. The state requires all drivers to have liability coverage. You also need collision and comprehensive coverage for a car loan or lease.

How we selected the cheapest car insurance companies in Arizona

LendingTree uses insurance rate data from Quadrant Information Services using publicly sourced insurance company filings. Rates are based on an analysis of hundreds of thousands of car insurance quotes for a typical driver. Prices are shown for comparative purposes only. Your own rates may be different.

Unless noted otherwise, quotes are for a full coverage policy for a 30-year-old man with good credit and a clean driving record who drives a 2018 Honda CR-V EX.

Coverage limits

Minimum liability policies provide liability coverage with the state’s required minimum limits.

Full coverage policies include collision, comprehensive and liability coverage:

- Bodily injury liability: $50,000 per person, $100,000 per accident

- Property damage liability: $50,000

- Uninsured/underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Collision: $500 deductible

- Comprehensive: $500 deductible

How we evaluated car insurance companies in Arizona

Our team of insurance experts rated insurance companies based on several categories. These categories include average rates, discounts, coverage options, third-party customer service ratings and app/website experience. We weighted these categories based on what customers value in an insurance company.

For third-party customer service ratings, we included complaint index scores from the National Association of Insurance Commissioners (NAIC) and financial strength ratings from AM Best. NAIC complaint index scores are used to determine how satisfied customers are with their claims, while financial strength ratings from AM Best reflect the ability to pay out claims.

—

*USAA is only available to current and former members of the military as well as certain family members.