When and How To Refinance a Personal Loan

Best personal loan refinance rates from 6.24%

Best personal loan refinance lenders with the lowest rates

Best for: Refinancing more than one personal loan – Best Egg

- APR

- 6.99% – 35.99%

The Annual Percentage Rate (APR) is the cost of credit as a yearly rate and ranges from 5.99% to 29.99%, which may include an origination fee from 0.99% – 6.99% that is deducted from loan proceeds. Any origination fee on a loan term 4-years or longer will be at least 4.99%. The loan term and the APR offered will depend on your credit score, income, debt payment obligations, loan amount, credit usage history and other factors. Additionally, the APR offered is impacted by your loan term and may be higher than our lowest advertised rate. Requests for the highest loan amount may result in an APR higher than our lowest advertised rate. You need a minimum 700 FICO® score and a minimum individual annual income of $100,000 to qualify for our lowest rate.

Best Egg loans are unsecured personal loans made by Cross River Bank, a New Jersey State Chartered Commercial Bank, Member FDIC. “Best Egg” is a trademark of Marlette Funding, LLC. All uses of “Best Egg” refer to “the Best Egg personal loan” and/or “Best Egg on behalf of Cross River Bank, as originator of the Best Egg personal loan,” as applicable. The term, amount and APR of any loan we offer to you will depend on your credit score, income, debt payment obligations, loan amount, credit history and other factors. Your loan agreement will contain specific terms and conditions. The timing of available funds upon loan approval may vary depending upon your bank’s policies. Loan amounts range from $2,000–$50,000. Residents of Massachusetts have a minimum loan amount of $6,500 ; New Mexico and Ohio, $5,000; and Georgia, $3,000. For a second Best Egg loan, your total existing Best Egg loan balances cannot exceed $50,000. Annual Percentage Rates (APRs) range from 5.99%–29.99%. The APR is the cost of credit as a yearly rate and reflects both your interest rate and an origination fee of 0.99%–6.99% of your loan amount, which will be deducted from any loan proceeds you receive. The origination fee on a loan term 4-years or longer will be at least 4.99%. Your loan term will impact your APR, which may be higher than our lowest advertised rate. You need a minimum 700 FICO® score and a minimum individual annual income of $100,000 to qualify for our lowest APR.

To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you.

QA Test

QA Test

QA Test

test

- Can pay up to 10 creditors automatically

- Online dashboard helps you track and manage your payments to creditors

- Have the option of offering collateral to get a bigger loan or a better rate

- Will deduct from your loan funds as an origination fee

- Can take up to 15 days for Best Egg to pay off your old loans

- Can’t add a co-borrower to your loan for better approval odds

If you’re consolidating debt by refinancing multiple personal loans at once, consider Best Egg . You can set up automatic payments and have your loan funds sent to up to 10 creditors. That way, you don’t have to pay them off one by one. Best Egg ’s online dashboard also makes it easy to ensure your Best Egg funds made it to the right accounts.

It can take up to 15 days for your refinance loan to reach your current lender(s), although a maximum of seven days is more typical.

You’re responsible for making payments until your new loan pays off your old balances in full. Keep a close eye on your current due dates while your debt is being consolidated to avoid missing a payment and hurting your credit.

You must meet the requirements below to qualify for a Best Egg loan:

- Citizenship: Be a U.S. citizen or permanent resident living in the U.S.

- Administrative: Have a personal checking account, email address and physical address

- Residency: Not live in the District of Columbia, Iowa, Vermont, West Virginia or U.S. territories

- Credit score: 580+

Best for: Those refinancing a lot of personal loan debt – BHG Financial

- APR

- 9.95% – 35.99%

- Can refinance up to $25,000

- Extra-long loan terms can help you fit a bigger loan into your budget

- U.S.-based customer service

- Must have at least $5,000 to refinance

- May find a lower rate elsewhere if you have excellent credit

- Will lose 0.00% – 0.00% of your loan funds to an origination fee

When you need to refinance a big personal loan, Avant may be a good fit. You can refinance up to $25,000, as long as you qualify.

Many people refinance personal loans to stretch out their loan term. BHG can help with that, too — you could have up to 48 months to pay off your refinance loan.

Although you need a credit score of at least to qualify in general, you likely won’t get approved for BHG’s biggest, longest-term loans unless you have excellent credit. BHG’s average borrower has a 744 FICO Score and an annual income of $241,000.

Avant also charges a steep origination fee of 0.00% – 0.00% . To put that into perspective, you’d receive $8,000 less in loan funds if you borrowed $200,000 with a 4.00% origination fee.

To get a loan from Avant , you’ll need to meet the following requirements:

- Administrative: Have a Social Security number and email address

- Credit score: +

Avant ’s average borrower has a score of 744, no past bankruptcies or accounts in collections and an annual income of $241,000. Not all of Avant ’s loans, loan amounts, rates or terms are available in all states.

Best for: Support during financial hardship – Discover

- APR

- 7.99% – 24.99%

The APR ranges from 7.99% to 24.99% APR based on creditworthiness at time of application. Loans up to $35,000. Fast & Easy Process. Terms are 36 to 84 months. No prepayment penalty. This is not a firm offer of credit. Any results displayed are estimates and we do not guarantee the applicability or accuracy to your specific circumstance. For example, for a $15,000 loan with an APR of 10.99% and 60 month term, the estimated monthly payment would be $326. The estimated total cost of the loan in this example would be $19,560.

Test

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Tellus pellentesque eu tincidunt tortor aliquam nulla facilisi cras fermentum. Leo vel orci porta non pulvinar neque laoreet. Ac turpis egestas aecenas pharetra convallis posuere. Morbi enim nunc faucibus a pellentesque sit amet porttitor. Euismod nisi porta lorem mollis aliquam ut porttitor leo a. Non pulvinar neque laoreet suspendisse. Leo urna molestie at elementum eu facilisis sed. Cras tincidunt lobortis feugiat vivamus at augue eget. Sit amet consectetur adipiscing elit ut aliquam. Diam donec adipiscing tristique risus nec feugiat in.

test

- May be willing to work with you if you’re having trouble paying

- Will quickly send loan proceeds to your old creditors

- No fees

- With a maximum loan amount of $40,000, it might not be a good fit if you have a lot of debt to refinance

- Borrowers won’t qualify with bad credit

- No joint loans

If you want a financial safety net for unexpected events like a job loss, Discover is worth considering. It offers a program designed to help borrowers if they’re having a hard time keeping up with their payments. Your account must have been active for the previous six months to qualify.

If you’re looking for a personal loan with no origination fee, Discover also fits that bill. It doesn’t charge any fees at all.

A Discover personal loan isn’t easy to qualify for, however. It requires very good credit and a moderate income. Discover also doesn’t offer joint applications, so you’ll have to qualify based on your credit alone.

You’ll need to meet these eligibility criteria to get a Discover personal loan:

- Age: Be at least 18 years old

- Citizenship: Have a Social Security number

- Administrative: Have a physical address, email address and internet access

- Income: Minimum income of $40,000 (individually or as a household)

- Credit score: +

Best for: Bad credit personal loan refinancing – Upstart

- APR

- 7.23% – 24.00%

The full range of available rates varies by state. A representative example of payment terms for a Personal Loan is as follows: a borrower receives a loan of $10,000 for a term of 60 months, with an interest rate of 21.58% and a 9.84% origination fee of $984, for an APR of 26.82%. In this example, the borrower will receive $9016 and will make 60 monthly payments of $275. APR is calculated based on 5-year rates offered in December 2023. There is no downpayment and no prepayment penalty. Your APR will be determined based on your credit, income, and certain other information provided in your loan application. Not all applicants will be approved.

QA Test

- Only need a + credit score

- Eligible college students and graduates with regular income don’t need credit at all

- Uses an algorithm to determine your creditworthiness, not just your credit score

- Can’t add a co-borrower to your loan to help you get approved

- Could pay a high origination fee

- App is only available for iPhone, not Android users

It can be easy to fall into the payday loan trap when you have bad credit. If you have at least Not specified to refinance, Upstart could be the way out of a triple-digit interest rate.

Upstart has one of the lowest minimum credit score requirements on the market. If you’re a college student about to graduate or you have at least an associate degree — and you have a job, job offer or proof of income — Upstart could waive its credit score requirement altogether.

Upstart does charge an origination fee. Generally, the lower your credit score, the more likely it is that this fee will apply — and the higher the fee will be. Upstart could charge a fee of of the loan amount.

Upstart has transparent eligibility requirements, including:

- Age: Be 18 or older

- Administrative: Have a U.S. address, personal banking account, email address and Social Security number

- Income: Have a valid source of income, including a job, job offer or another regular income source

- Credit-related factors: No bankruptcies within the last three years, minimal recent inquiries on your credit report and no current delinquencies

- Credit score: + (unless you’re an eligible college student or graduate, in which case Upstart could approve you with no credit)

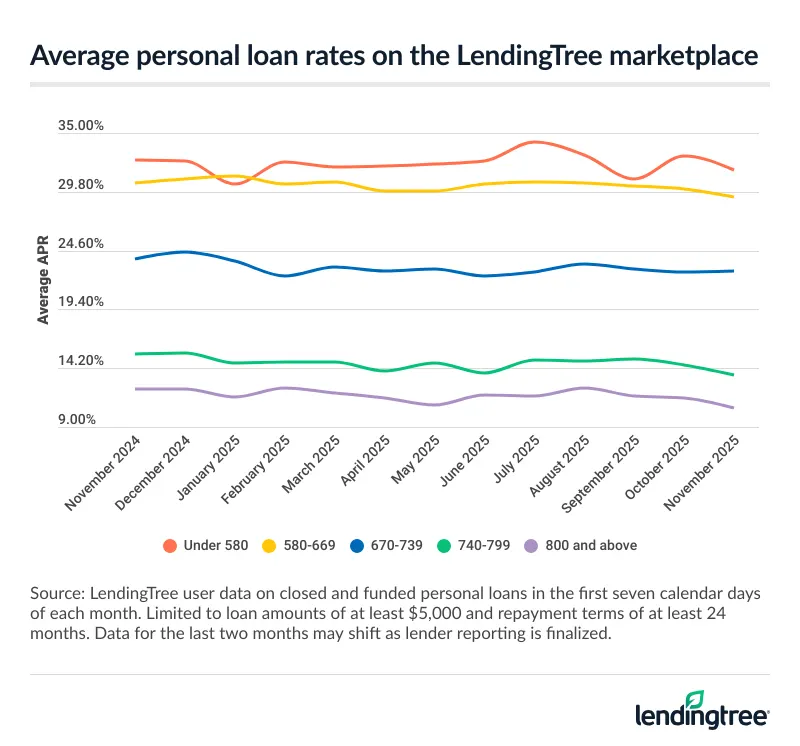

Personal loan refinance rates

Below are the average personal loan rates that LendingTree users found through our marketplace in the second quarter of 2025. Find your credit tier and check what rate you might get.

| Credit tier | Average APR |

|---|---|

| Excellent (800+) | 11.66% |

| Very good (740-799) | 14.35% |

| Good (670-739) | 22.83% |

| Fair (580-669) | 30.22% |

| Poor (under 580) | 32.09% |

Track personal loan rates with LendingTree

Personal loan annual percentage rates (APRs) haven’t changed significantly over the last year, but they have ticked up slightly in recent months — except among those with bad credit. Our data shows that if you have a credit score of 669 or less, you may find that refinancing your current personal loan is more affordable than it was just a few months ago.

See how your refinance loan rate compares to your current loan

Why do millions of Americans trust LendingTree?

25+ years in business. 110+ million Americans served. $260+ billion in funded loans.

Security

Instead of sharing information with multiple lenders, fill out one simple, secure form in five minutes or less.

Savings

We’ll match you with up to five lenders from our network of 300+ lenders who will call to compete for your business.

Support

We provide ongoing support with free credit monitoring, budgeting insights and personalized recommendations to help you save.

When banks compete, you win

You’d shop around for flights. Why not your loan? LendingTree makes it easy. Fill out one form and connect with our network of banks and other trusted lenders.

Tell us what you need

Take two minutes to tell us who you are and how much money you need. It’s free, simple and secure.

Shop your offers

Our users get 18 personal loan offers on average. Compare your offers side by side to get the best deal.

Get your money

Pick a lender and sign your loan paperwork. You could see money in your account in as soon as 24 hours.

What is personal loan refinancing?

Refinancing a personal loan is the act of replacing your current personal loan with a new one. Personal loan refinancing can make your debt more affordable by:

- Reducing your total interest if you qualify for a better rate

- Lowering your monthly payment by refinancing to a longer term

- Helping you pay off debt faster by refinancing to a shorter term

How to refinance a personal loan

Personal loan refinancing sounds complicated, but it doesn’t have to be. Here’s how to get started.

-

Calculate how much personal loan debt you have

You can refinance one loan or several at once (called debt consolidation). Add up your balances so you know how much money to apply for. -

Prequalify for refinancing

Check rates on the LendingTree marketplace without hurting your credit. See if you can save with a new interest rate or a lower monthly payment with a longer loan term. -

Choose a lender and close the loan

Some lenders pay off your old loan directly. Others give you the money, which you’ll use to pay off your previous personal loan. -

Start repayment

Your first refinance payment is usually due within 30 to 45 days. From then on, you’ll only make payments on the new loan.

How personal loan refinancing can save you money

Refinancing a personal loan to one with a lower rate can reduce your total interest and lower your monthly payment. Even if the rate drop seems small, you could save thousands of dollars over the life of your loan.

| Scenario | Original loan | Refinanced loan | Difference |

|---|---|---|---|

| Loan balance or amount | $20,000 | $20,000 | – |

| Loan terms | 60 months | 60 months | – |

| APR | 23.00% | 14.00% | 9.00% |

| Monthly payment | $564 | $465 | -$99 |

| Total interest paid | $13,829 | $7,922 | -$5,907 |

Step-by-step math

Here’s how we did the math in this example. When you’re comparing loan offers, use LendingTree’s personal loan calculator to see potential monthly charges and interest payments.

1. Original loan: Borrowing $20,000 at 23% APR over 60 months leads to a monthly payment of $508 and $13,289 in total interest paid.

2. Refinanced loan: Borrowing $20,000 at 14% APR over 60 months leads to a monthly payment of $465 and $7,922 in total interest paid.

3. Savings: $13,829 – $7,922 = $5,907 less interest paid over the life of the loan, and a monthly payment of about $99 less.

Borrowers with good credit (credit score of 670-739) qualify for an average APR of about 23% on the LendingTree marketplace. Borrowers in the “very good” category (credit score of 740-799) received an average APR of about 14%.

In this example, moving up just one credit tier saved the borrower close to $6,000 over the loan term. Download LendingTree Spring to get your free credit score along with personalized tips on how to improve your credit.

Other ways that refinancing can help

Refinancing isn’t always about saving on interest. You might be able to reduce your monthly payments by choosing a longer loan term, even if you don’t qualify for a better rate.

By choosing a longer loan term, you’ll break up your balance into more payments. This results in a lower payment each month, but you’ll pay more in interest overall.

Refinancing can also help you get out of debt faster if you pick a shorter loan term. This will condense your debt into a smaller window, increasing your monthly payments but reducing the total interest paid.

When it’s a good idea to refinance a personal loan

Here are three signs that it could be a good time to refinance your personal loan:

- Your credit score has improved — If your credit score has improved substantially since you got your original loan, you might get a lower interest rate by refinancing. A lower interest rate can save you money over the life of the loan.

- Interest rates have gone down — Personal loan rates reached their highest levels since 2007 in early 2024. If this is around the time you took out your original loan, you might qualify for a better rate based on market conditions.

- You need lower payments — When you need to lower your monthly payments, think about refinancing into a longer-term loan. This should lower your payment, but it will also increase the total amount of interest you’ll pay over time.

- You want to pay the loan off faster — If you want to pay off your loan faster, consider refinancing into a shorter loan term. Your monthly payment will go up if you go this route, but you’ll save on interest costs.

When you should wait to refinance a personal loan

Here are three signs you should wait to refinance:

- You can’t get a lower interest rate — Whether interest rates have risen or your credit score has dropped, it may not make sense to refinance if you don’t qualify for a lower interest rate.

- You’re facing a lot of fees — Some personal loans come with an origination fee, which the lender usually deducts from your loan amount. Your current lender could also charge a prepayment penalty (although this is rare). If the fees aren’t worth the possible benefits, refinancing may not be a good idea.

- You can’t afford your debt, even after refinancing — Refinancing won’t change how much you owe. If you have more debt than you can pay, it might be time to consider bankruptcy or debt relief.

What sets LendingTree content apart

Expert

Our personal loan writers and editors have 32 years of combined editorial experience and 28 years of combined personal finance experience.

Verified

100% of our content is reviewed by certified personal finance professionals and meets compliance and legal standards.

Trustworthy

We put your interests first. We’ll tell you about any loan drawbacks and be clear about when to consider alternatives.

Frequently asked questions

Once you refinance a loan, you can’t reverse the process. It’s important to know the downsides before making a final decision. Some drawbacks of personal loan refinancing include:

- Higher interest charges if you choose a longer loan term

- Possible origination fees with your new lender

- Possible prepayment penalties with your old lender

- A small dip in your credit due to a hard credit pull (usually five points or fewer)

- Could switch to a lender with poor customer service (LendingTree user reviews can help prevent this)

While every lender has its own eligibility criteria, generally, a good credit score (670+) is required to qualify for personal loan refinancing. Lenders typically start offering their best rates once you hit 740+.

Some lenders, like Upstart

and Best Egg

, accept fair and bad credit scores. Rates may not be lower than what you’re currently paying, but you can still refinance to get a lower monthly payment with a longer loan term.

Lenders also look at other factors, like your debt-to-income ratio (DTI). This is how much you currently owe per month compared to your income. Most lenders prefer a DTI of 35% or less, but the lower, the better.

Because every lender has its own eligibility requirements, the best way to see if you qualify for personal loan refinancing is by prequalifying. It won’t hurt your credit score and will show you what rates to expect from each lender.

Some lenders will refinance their own loans, but not all. , for instance, won’t refinance its own loans. Although it might feel more comfortable refinancing with your current lender, you should still shop around.

On the LendingTree marketplace, you can check refinance rates with the nation’s largest network of lenders with just one form. It’s possible you might get the best deal from your current lender, but you won’t know unless you compare multiple offers.

Our methodology

We reviewed more than 30 lenders that offer personal loans to determine the overall best six lenders by these metrics. According to our systematic rating and review process, the best personal loans come from Best Egg, BHG Financial, Discover, LightStream, SoFi and Upstart. LendingTree reviews and fact-checks our top lender picks on a monthly basis.

Accessibility. We look for lenders with fewer barriers to approval and award points for lower credit requirements, nationwide access, fast funding and simple applications.

Rates and terms. We prioritize lenders that offer low starting rates, minimal fees, flexible terms and APR discount opportunities.

Repayment experience. We choose lenders with strong reputations, convenient self-service tools, responsive support and borrower-friendly perks.

Why trust our methodology?

Our writers and editors dig through the facts, contact lenders directly and even go through the application process ourselves if it helps better explain what you can expect. As a Certified Financial Education Instructor℠, I’m committed to breaking down complex financial details so people can make confident, informed decisions with their money.

Jessica’s experience in editing and financial education helps shape LendingTree articles that are clear, accurate and truly useful to readers. Her certification means our recommendations are built on a foundation of consumer-first financial knowledge — not just numbers.