APR: An annual percentage rate (APR) measures the total cost of your loan, including interest and fees. The lower your APR, the cheaper your loan.

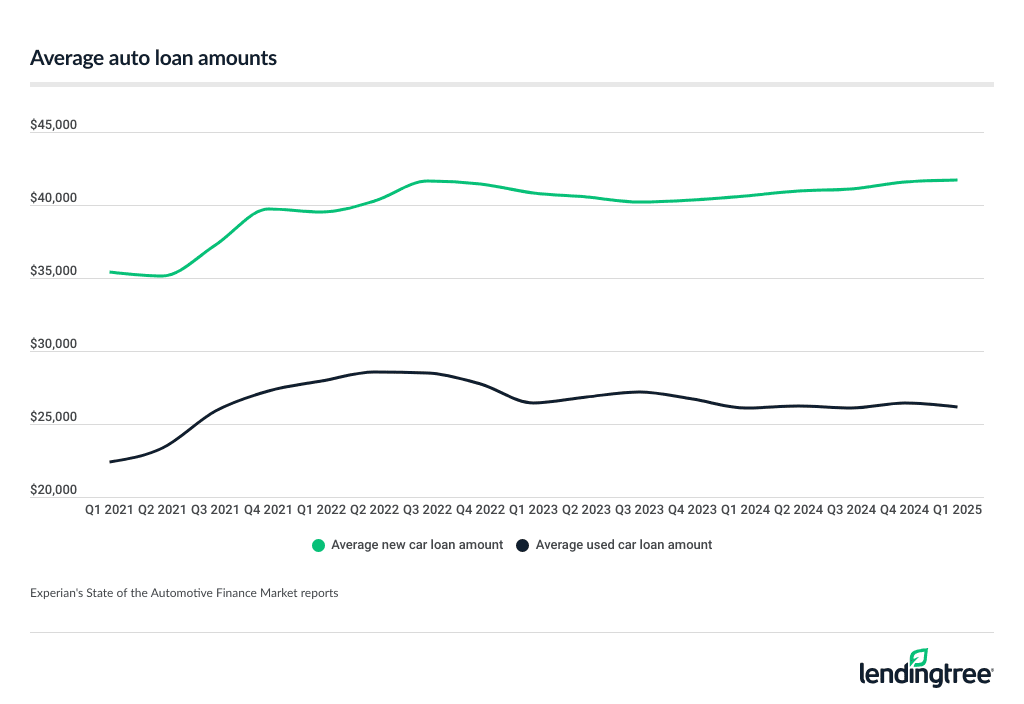

Loan amount: Most auto loan amounts start at several thousand dollars. If you want to finance a cheaper used car, make sure the lender’s loan amounts fit your needs.

Financing term: Your financing term is the length of time you have to pay off your loan. Terms between 12 and 84 months are the most common. The longer your term, the lower your monthly payment usually is. On the flip side, a long term could also mean more interest over the life of the loan.

Fees: Buying a car can come with mandatory fees, like taxes, titling and registration. Some dealer fees are optional, like those associated with extended warranties. Always ask for the out-the-door price, and don’t be afraid to turn down options that you aren’t interested in.

Lender reputation: Avoid getting stuck with a bad company by reading customer reviews. LendingTree lender reviews are a good place to start. You should also check for official complaints on the Consumer Financial Protection Bureau (CFPB) customer complaint database.

The CFPB customer complaint database seems intimidating, but it’s not hard once you know what you’re doing. Once you’re on the database (use the link in the section above):

- Click the “All data” dropdown menu and choose “Company name.”

- Type the lender’s name into the search term box.

- Choose the closest match.

- Click the “List” tab in the middle of the screen to read specific consumer complaints.

You can also sort by date, product type, location and tons of other data points. This powerful tool can give you a glimpse into what it’s like to work with specific lenders.