More Than 4 in 10 Millennials Refinanced Over Past Year, Almost Double The Overall Average

More than 4 in 10 millennial homeowners refinanced their mortgage during the coronavirus pandemic, according to a LendingTree survey. Read More

More than 4 in 10 millennial homeowners refinanced their mortgage during the coronavirus pandemic, according to a LendingTree survey. Read More

Planning to make your home more energy-efficient? Here are four improvements that make a difference and some ways to finance the upfront cost. Read More

Learn the benefits and risks of getting a no-closing-cost mortgage to help you decide whether it's the right home loan for you. Read More

More than a third of Americans have decided against buying a home because of a superstition, according to a LendingTree survey. Read More

Gen Xers make up the largest share of potential homebuyers in Miami, Riverside, Calif., and Las Vegas. Here's our breakdown. Read More

Americans owe $12.94 trillion on 86.47 million mortgages. Learn more about this — and how they’re managing and using that debt. Read More

Learn what it means to borrow a jumbo mortgage and how to meet jumbo loan requirements. Read More

LendingTree analyzed U.S. Census Bureau data on homeownership rates for Black people in the nation's 50 largest metros. Read More

If you’re an active-duty service member, veteran or eligible surviving spouse, you’ll want to learn the steps needed to get a VA loan. Read More

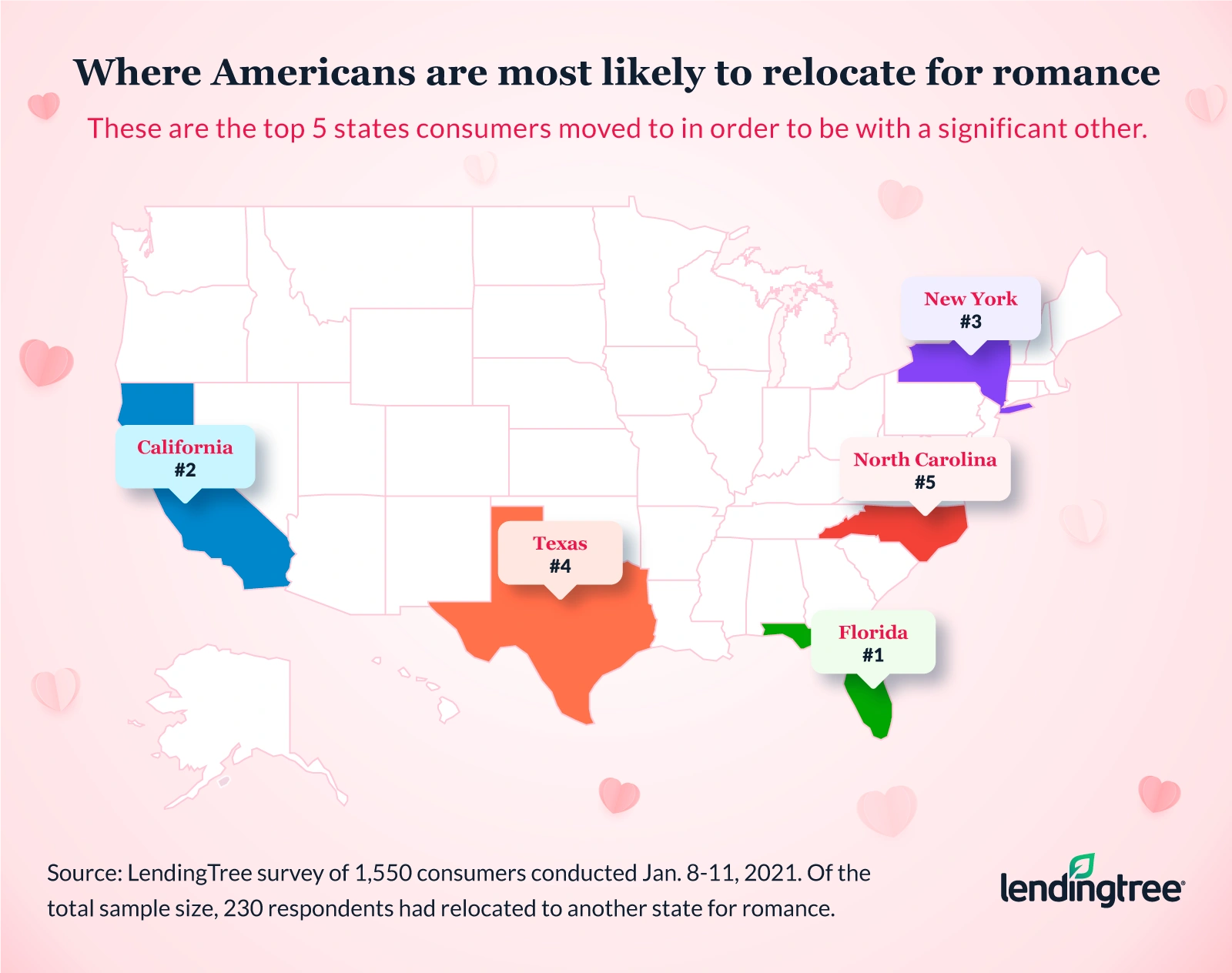

A LendingTree survey revealed about 4 in 10 Americans have moved for love, and men are more willing to relocate than women. Read More