Best Personal Loan Companies with the Lowest Rates in December 2025

We’ve named SoFi the best personal loan lender overall — it has fast funding and lets you skip upfront fees

- Winner: is LendingTree’s pick for the best personal loan company in December 2025.

- Why we like it: offers some of the fastest funding on the market and lets you skip upfront fees (they’re optional).

- Runners-up: and Upgrade . Both offer low rates and unique perks that make them strong alternatives and top LendingTree picks.

Top 10 best personal loan companies

What is the best personal loan company right now?

For December 2025, is the best personal loan company according to our methodology because it offers quick funding, optional fees and competitive rates.

Other top personal loan companies include Upgrade (low rates and accessible to people with fair credit) and (low rates and no fees).

LendingTree personal loan experts hand-select each of our top lenders and evaluate them for how easy they are to qualify for, cost and ease of repayment — the factors that matter most to you. Learn more about how we rate lenders.

How LendingTree works

You’d shop around for flights. Why not your loan? LendingTree makes it easy. Fill out one form and get lenders from the country’s largest network to compete for your business.

1. Tell us what you need

Take two minutes to tell us who you are and how much money you need. It’s free, simple and secure.

2. Shop your offers

LendingTree users who get at least one offer receive 20 personal loan offers on average. Compare your offers side by side to get the best deal.

3. Get your money

Pick a lender and sign your loan paperwork. You could see money in your account in as soon as 24 hours.

Best personal loan companies

Best for: Runner-up, overall personal loans – Upgrade

- APR

- 7.99% – 35.99%

Personal loans made through Upgrade feature Annual Percentage Rates (APRs) of 7.99%-35.99%. All personal loans have a 1.85% to 9.99% origination fee, which is deducted from the loan proceeds. Lowest rates require Autopay and paying off a portion of existing debt directly. Loans feature repayment terms of 24 to 84 months. For example, if you receive a $10,000 loan with a 36-month term and a 17.59% APR (which includes a 13.94% yearly interest rate and a 5% one-time origination fee), you would receive $9,500 in your account and would have a required monthly payment of $341.48. Over the life of the loan, your payments would total $12,293.46. The APR on your loan may be higher or lower and your loan offers may not have multiple term lengths available. Actual rate depends on credit score, credit usage history, loan term, and other factors. Late payments or subsequent charges and fees may increase the cost of your fixed rate loan. There is no fee or penalty for repaying a loan early. Personal loans issued by Upgrade’s bank partners. Information on Upgrade’s bank partners can be found at https://www.upgrade.com/bank-partners/.

- Recommended by 97% of LendingTree users who borrow from Upgrade

- Get money in as soon as one business day

- Can send money directly to your creditors if you’re consolidating

- Customer service available every day of the week, including weekends

- Fair credit OK

- Charges an upfront origination fee

- Some other lenders offer a lower starting APR

“Upgrade has been fantastic to work with. Their platform is extremely easy to use. I barely touch anything because I have autopay set up, but it’s been really easy to make changes with payment methods.” – Sammi Scharf, LendingTree writer

Lending platform Upgrade stands out for its borrower-friendly features, low qualification requirements and highly rated customer service. Upgrade lets you save with three APR discount opportunities or by applying for a joint personal loan for better odds at a lower rate.

Keep in mind that if you take out an Upgrade personal loan, you’ll pay an upfront origination fee of 1.85%-9.99% of your loan amount. Want to skip the fees? Check out no-fee lenders like , Discover and .

To qualify for a loan through Upgrade , you must meet the requirements below:

- Age: Be at least 18 years old (19 in some states)

- Citizenship: Be a U.S. citizen, permanent resident or live in the U.S. with a valid visa

- Administrative: Have a valid bank account and email address

- Credit score: 580+

Best for: Lowest rates with collateral – Best Egg

- APR

- 7.99% – 35.99%

- Secured loans are generally easier to qualify for and can come with lower rates

- Get money in as soon as 24 hours

- Fair credit OK

- Not available in Iowa, Vermont, West Virginia or the District of Columbia

- Charges an upfront fee on every loan

- Can’t apply for a loan with another person

I shopped for personal loans with Best Egg using my real information. Here’s what I found:

- Application experience: Best Egg asks more questions than the average lender, but its application is clear and easy to complete. Once you have offers, you can quickly click through to a loan agreement that outlines the next steps and how much you’ll pay.

- Unusual questions to prepare for: Annual income for other people in your household, other types of accounts held (e.g., savings, retirement and investments), car payment, number of cash advances taken in past six months

If you have fair to good credit, own your home and want to boost your approval odds, Best Egg ’s secured loan for homeowners is worth considering. You’ll back your Best Egg secured loan with fixtures from your house like cabinets and lighting. Offering collateral can make it easier to get a loan (or even lower rates) because it reduces the lender’s risk.

Think twice about Best Egg ’s secured loan if you’re planning to move or refinance — it’ll be hard to sell or refinance your home while you have a lien on the fixtures. Also note that you can’t apply for a Best Egg loan with another person (like the co-owner of your house, for instance).

Best Egg uses built‑in home fixtures as collateral but doesn’t require an appraisal of them. It reviews your credit history and home equity instead.

You must also meet the requirements below to qualify for a Best Egg loan:

- Age: Be of legal age to accept a loan in your state (usually 18)

- Citizenship: Be a U.S. citizen or permanent resident living in the U.S.

- Administrative: Have a personal checking account, email address and physical address

- Residency: Not live in the District of Columbia, Iowa, Vermont, West Virginia or U.S. territories

- Credit score: +

Best for: Excellent customer service and no fees – Discover

- APR

- 7.99% – 24.99%

The APR ranges from 7.99% to 24.99% APR based on creditworthiness at time of application. Loans up to $35,000. Fast & Easy Process. Terms are 36 to 84 months. No prepayment penalty. This is not a firm offer of credit. Any results displayed are estimates and we do not guarantee the applicability or accuracy to your specific circumstance. For example, for a $15,000 loan with an APR of 10.99% and 60 month term, the estimated monthly payment would be $326. The estimated total cost of the loan in this example would be $19,560.

Test

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Tellus pellentesque eu tincidunt tortor aliquam nulla facilisi cras fermentum. Leo vel orci porta non pulvinar neque laoreet. Ac turpis egestas aecenas pharetra convallis posuere. Morbi enim nunc faucibus a pellentesque sit amet porttitor. Euismod nisi porta lorem mollis aliquam ut porttitor leo a. Non pulvinar neque laoreet suspendisse. Leo urna molestie at elementum eu facilisis sed. Cras tincidunt lobortis feugiat vivamus at augue eget. Sit amet consectetur adipiscing elit ut aliquam. Diam donec adipiscing tristique risus nec feugiat in.

test

- U.S.-based loan specialists available seven days a week

- Get money as soon as the next business day

- Repayment assistance options if you can’t make payments

- No upfront fees

- Can’t apply for a loan with another person

- Need good or excellent credit to qualify

- Can only borrow up to $40,000

I shopped for personal loans with Discover using my real information. Here’s what I found:

- Application experience: Discover ’s application process was quick and easy — there were only a few questions and the interface was intuitive. I got instant offers, and Discover gave me a reference number to log back in and review them again later.

- Unusual questions to prepare for: None! Just remember to have your Social Security number on hand.

With a 97% approval rating from LendingTree users, Discover earns high marks for customer satisfaction. Its U.S.-based loan specialists are available seven days a week, take phone calls and offer extended customer service hours as late as 11 p.m. ET on weekdays.

Discover personal loans only go up to$40,000, so if you’re looking for a large personal loan, consider other lenders on this list like or .

You’ll need to meet these eligibility criteria to get a Discover loan:

- Age: Be at least 18

- Citizenship: Have a Social Security number

- Administrative: Have a physical address, email address and internet access

- Income: Minimum income of $40,000 (individually or as a household)

- Credit score: +

Best for: Joint loans, fair credit OK – LendingClub

- APR

- 7.95% – 29.99%

All loans are subject to credit review and approval. Your actual rate depends upon credit score, loan amount, loan term, credit usage and history. Currently loans are not offered in: MA, MS, NE, NV, OH, and WV.

- Get money as soon as 24 hours

- Available to people with fair credit

- Can apply with another person for better odds of approval

- May charge upfront origination fee (0.00%-5.00%)

- Borrowers with bad credit won’t qualify

If you have fair credit and want to boost your odds of getting a loan with lower rates, check out Happy Money . While many lenders don’t offer joint loans, Happy Money allows co-borrowers — and one with good credit can help you qualify, get lower rates and even qualify for more money.

Happy Money sometimes charges an upfront origination fee that it takes out of your loan before sending you money. You won’t qualify for a Happy Money loan with bad credit, so check out and Upstart if your credit score is below 580.

To be eligible for a Happy Money personal loan, you must meet the following requirements:

- Age: Be at least 18 years old

- Citizenship: Be a U.S. citizen or permanent resident

- Administrative: Have a verifiable bank account

Best for: Bad or no credit – Upstart

- APR (Test)

- 7.23% – 24.00%

The full range of available rates varies by state. A representative example of payment terms for a Personal Loan is as follows: a borrower receives a loan of $10,000 for a term of 60 months, with an interest rate of 21.58% and a 9.84% origination fee of $984, for an APR of 26.82%. In this example, the borrower will receive $9016 and will make 60 monthly payments of $275. APR is calculated based on 5-year rates offered in December 2023. There is no downpayment and no prepayment penalty. Your APR will be determined based on your credit, income, and certain other information provided in your loan application. Not all applicants will be approved.

QA Test

- Low or no credit won’t disqualify you

- Get money in as soon as one business day

- Consistently rated top 3 in customer satisfaction by LendingTree users

- Can’t take out a loan with another person

- Only two repayment terms to choose from (12 or 84 months)

- May charge an origination fee ()

“I had never taken out a personal loan before, but it only took me a few minutes to fill out Upstart ’s application and hear back about whether I prequalified. On top of that, I got to skip paying an origination fee — which saved me money — and the monthly payments ended up fitting my budget.” – Amanda Push, LendingTree deputy editor

Upstart loans are worth considering for applicants with limited or bad credit history. Unlike most other lenders, Upstart offers loans to borrowers who are credit invisible or don’t have long enough credit histories to generate a credit score.

You’ll likely pay a high price to get an Upstart loan if you have bad or no credit. Upstart charges rates as high as 24.00%, and you could get stuck with an expensive origination fee.

Upstart has transparent eligibility requirements, including:

- Age: Be 18 or older

- Administrative: Have a U.S. address, personal banking account, email address and Social Security number

- Income: Have a valid source of income, including a job, job offer or another regular income source

- Credit-related factors: No bankruptcies within the last three years, reasonable number of recent inquiries on your credit report and no current delinquencies

- Credit score: + (unless you’re an eligible college student or graduate, in which case Upstart could approve you with no credit)

What is a personal loan?

A personal loan gives you a lump sum of money that you’ll pay back in equal monthly payments. The lender will usually send the money straight to your bank account — sometimes as soon as the same day.

What else to know:

-

Fixed interest

Interest stays the same during the loan, and so do your payments. Credit card interest goes up and down with the market. -

How to qualify

There’s no universal minimum credit score for personal loans — but the better your credit, the cheaper your loan will likely be. Learn more about personal loan requirements. -

How to apply

You can apply for a personal loan on the lender’s website or use a service like LendingTree to get quotes from up to five lenders at once.

Personal loans are a popular solution for dealing with debt. Nearly three quarters (72%) of Americans have a personal loan, have had one in the past or have considered getting one, according to a LendingTree survey.

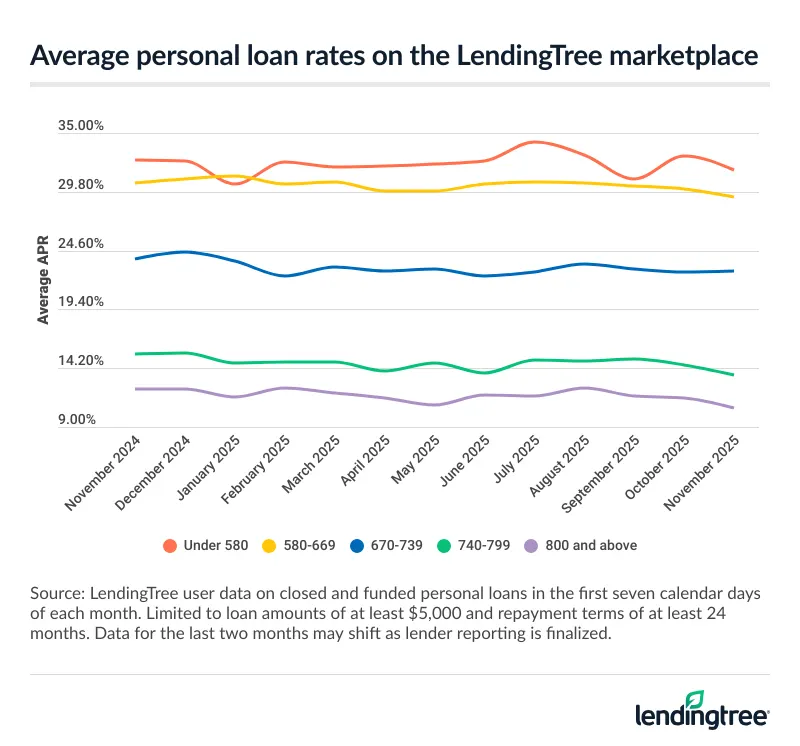

Personal loan rates

We’ve compiled the average personal loan rates for LendingTree marketplace users so you can estimate the rates you’ll likely qualify for based on your credit score.

| Credit tier | Average APR |

|---|---|

| Excellent (800 and above) | 11.66% |

| Very good (740-799) | 14.35% |

| Good (670-739) | 22.83% |

| Fair (580-669) | 30.22% |

| Poor (under 580) | 32.09% |

Track personal loan rates with LendingTree

Personal loan rates have held steady over the past year, but they remain relatively high — making it more important than ever to compare lenders and find the best offer for your credit profile.

Calculate your loan payments

How much will your loan cost?

It’s hard to know how much your loan will actually cost when you’re looking at broad APR ranges. We’ll walk you through how to estimate the cost of your loan in dollars and cents.

Let’s assume you borrow $5,000 over a loan term of 48 months. Let’s also assume your loan has no fees. Here’s a quick estimate of the cost of your loan in dollars and cents.

| Credit score range | Average APR | Monthly payment | Interest | Total cost |

|---|---|---|---|---|

| Excellent (800 and above) | 11.66% | $130.84 | $1,280.13 | $6,280.13 |

| Very good (740-799) | 14.35% | $137.51 | $1,600.57 | $6,600.57 |

| Good (670-739) | 22.83% | $159.79 | $2,670.02 | $7,670.02 |

| Fair (580-669) | 30.22% | $180.67 | $3,672.17 | $8,672.17 |

| Poor (under 580) | 32.09% | $186.16 | $3,935.60 | $8,935.60 |

Improving your credit before getting a loan will help you get lower rates and save money. You could save more than $1,804 on your loan by raising your score from “fair” to “very good.”

How to choose the best loan

Once you have loan offers, use our loan calculator to compare APRs, monthly payment and total interest payments. Here’s what to expect and watch out for based on your credit score:

| Your credit band | Probable offers | Tips |

|---|---|---|

| Excellent (800 and above) | Low rates, options with no fees | Prioritize offers with low rates and no origination fee. |

| Good to very good (670-799) | Slightly higher rates, may need to pay fees | Lenders deduct origination fees before sending your loan, so make sure you’ll get the full amount of money you need. |

| Fair (580-669) | Fewer options with higher rates, fees likely | Find the offer with the lowest APR that has a monthly payment you can afford. |

| Poor (under 580) | Few options, highest rates | Add a co-borrower or collateral for lower rates and better odds of approval. |

Expert insights on finding the lowest personal loan rate

If you don’t shop around for the best rate on your next personal loan, you’re probably going to pay too much. Rates, terms and amounts can vary significantly by lender, so it is absolutely worth the effort to compare offers from multiple personal loan companies.

Life’s too expensive today to settle for paying more than you need.

Best loan companies for every need

Frequently asked questions

Of our top picks for December 2025, Best Egg offers the lowest starting rate (7.99% APR) for secured personal loans, and offers the next-lowest starting rate ( APR with autopay) for unsecured loans.

LendingTree’s top 10 lenders offer safe personal loans that you can apply for online. Read about personal loan disadvantages to protect yourself from the risks that come with any personal loan.

Choosing the right personal loan lender is all about shopping around. Prequalify with several lenders, compare your offers and choose the one that fits your budget. You can get offers from up to five lenders at once with LendingTree.

Online-only lenders typically offer fast funding and can be easier to qualify for than traditional personal loans from brick and mortar banks, but they sometimes come with one-time origination fees that can make your loan more expensive.

Yes, some personal loan comparison sites are trustworthy. LendingTree writers and editors evaluate lenders impartially and don’t receive compensation for their reviews. Learn more about how we review lenders.

Our methodology

We reviewed more than 30 lenders that offer personal loans to determine the overall best 10 lenders by these metrics. According to our systematic rating and review process, the best personal loans come from SoFi, Upgrade, Best Egg, Discover, LendingClub, LightStream, PenFed, Prosper, Rocket Loans and Upstart. LendingTree reviews and fact-checks our top lender picks on a monthly basis.

Accessibility. We look for lenders with fewer barriers to approval and award points for lower credit requirements, nationwide access, fast funding and simple applications.

Rates and terms. We prioritize lenders that offer low starting rates, minimal fees, flexible terms and APR discount opportunities.

Repayment experience. We choose lenders with strong reputations, convenient self-service tools, responsive support and borrower-friendly perks.

Why trust our methodology?

Our writers and editors dig through the facts, contact lenders directly and even go through the application process ourselves if it helps better explain what you can expect. As a Certified Financial Education Instructor℠, I’m committed to breaking down complex financial details so people can make confident, informed decisions with their money.

Jessica’s experience in editing and financial education helps shape LendingTree articles that are clear, accurate and truly useful to readers. Her certification means our recommendations are built on a foundation of consumer-first financial knowledge — not just numbers.