Personal Line of Credit Rates from 9.50% in December 2025

A smarter way to borrow for ongoing expenses, with lower interest rates

Personal line of credit rates

Personal lines of credit lenders at a glance

First Tech Federal Credit Union

Why use LendingTree?

$2.8B in funding

In 2024 alone, LendingTree helped find funding for over $2.8 billion in personal loans.

$1,659 in savings

LendingTree users save $1,659 on average just by shopping and comparing rates.

309,000 loans

In 2024, LendingTree helped find funding for over 309,000 personal loans.

When banks compete, you win

You shop around for flights. Why not your loan? LendingTree makes it easy. Fill out one form and get lenders from the country’s largest network to compete for your business.

Tell us what you need

Take two minutes to tell us who you are and how much money you need. It’s free, simple and secure.

Shop your offers

Our users get 18 personal loan offers, on average. Compare your offers side by side to get the best deal.

Get your money

Pick a lender and sign your loan paperwork. You could see money in your account in as soon as 24 hours.

What is a personal line of credit?

A personal line of credit (PLOC) is a type of revolving debt. Instead of getting a lump sum of money like you would with a loan, you can borrow over and over again, up to your borrowing limit. Making payments frees up credit that you can use again.

However, there are some distinct differences between PLOCs and credit cards:

- Interest starts accumulating immediately on a PLOC, while credit cards get a grace period.

- Some PLOCs only let you borrow for a certain amount of time.

- PLOC interest rates are usually lower than credit card rates.

How does a personal line of credit work?

PLOCs can be intimidating. They aren’t very common. Plus, each lender has a different way of handling them. Generally, there are three ways a PLOC can work, and they all have to do with when you can borrow and when you’re required to pay.

When you’re approved for a line of credit, you might not get a card. Not many lenders offer cards for their PLOCs. Instead, you’ll probably get a checkbook and/or access to an online portal so you can transfer funds electronically.

| Type of PLOC | How it works |

|---|---|

| Continuous draw period | Borrow anytime, as long as you have the credit available and your lender hasn’t closed your line of credit |

| Draw period/repayment period | Borrow and make minimum monthly payments during your draw period; pay your outstanding balance during your repayment period |

| Simultaneous repayment period | Borrow and repay at the same time; outstanding balance is due at the end of your PLOC (called maturity) |

PLOC fast facts

Not every bank offers PLOCs

PLOCs can be hard to find, but some lenders on the LendingTree marketplace do offer them, as do the lenders on this list. Otherwise, check with local banks and credit unions.

PLOCs usually require good credit

You could get a PLOC with bad credit, but traditional banks and credit unions usually require a 670+ FICO Score.

PLOCs almost always have variable interest rates

Variable interest rates are guided by the Wall Street Journal prime rate, so they go up and down while your line is open.

PLOCs typically have lower rates than credit cards

The current average credit card rate is 24.35%, according to LendingTree’s monthly report. The lowest PLOC rate on this list starts at .

PLOCs can have a lot of fees

Compared to personal loans, PLOCs have a lot of fees. You might even get charged for simply using your PLOC.

Making sense of PLOC rates

You might see a PLOC rate advertised as prime, plus the lender’s rate. It can look confusing — here’s how to decipher it.

Imagine a lender is offering Prime + 4.00% to Prime + 22.50%. First, find the Wall Street Journal prime rate. Then, take that number and add it to 4.00% and 22.50%.

At the time of this writing, Prime is 7.25%. So in this example, the lender’s current PLOC rates are 11.25% to 29.75%.

How to use a personal line of credit

PLOCs can be a great way to finance larger, planned purchases with no set price tag. Let’s say you’re remodeling your home and, while you have a good idea of how much things will cost, you want to plan ahead in case the contractor finds hidden damage.

A personal loan could work. It’ll give you a lump sum of money. The problem is that you aren’t sure how much to borrow. You could ask for a larger loan, but you’ll pay interest on the entire amount you borrowed (even if you didn’t end up needing it).

You could get a 0% intro APR card, but this is a long-term project. You’re worried that the house might not be done by the time your intro period is over.

In that case, a PLOC might be your best choice. You can borrow when you need to, and you’ll only pay interest when you make a charge. PLOCs can also be good for:

- Emergency expenses

- Medical bills resulting from a chronic condition

- Bridging the gap if you’re a seasonal or gig worker

- Wedding expenses

- Moving and relocation

- Overdraft protection

Personal line of credit pros and cons

PLOCs aren’t as popular as credit cards and personal loans, but they can come in handy for expenses that don’t have a clear price tag. Still, PLOCs have drawbacks you should consider.

PROS

- Tend to have lower rates than credit cards

- Gives you access to a steady stream of money

- Only pay interest on what you borrow

CONS

- Interest starts accruing as soon as you charge

- You usually need at least good credit to get a PLOC

- More fees than other types of loans

- Interest rates go up and down with the market, in most cases

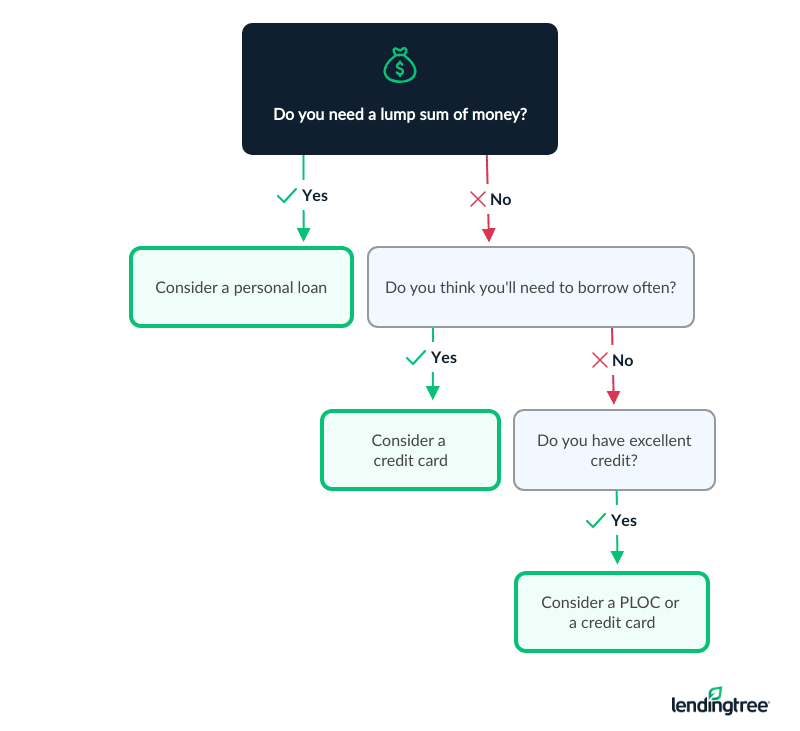

How to choose between a personal line of credit, personal loan or a credit card

Choosing between a PLOC, personal loan or a credit card can seem intimidating, but it’s easier if you break it down based on how you need the money and how often.

From the expert: When a PLOC may be the better choice

When might a PLOC be the better choice?

If you want to consolidate debt or make a major purchase with a fixed price, a personal loan would be preferable. PLOCs and credit cards are similar, so knowing which to choose is tricky. If you have excellent credit, you might qualify for lower rates on a PLOC. But if your credit needs work or you want to earn rewards, the latter option may be a better fit.

Alternatives to personal lines of credit

The great thing about personal finance is that it’s personal. There are tons of different financing options available, so no worries if a PLOC isn’t a good fit.

Credit card

Credit cards make more sense for everyday purchases — as long as you pay your balance in full each month.

Credit cards come with a built-in grace period. You won’t have to pay interest as long as you pay your balance in full every month. With PLOCs, there’s no way to avoid interest — it starts accruing interest as soon as you make the charge.

Some credit cards earn cash back and rewards. Using them responsibly to pay for things like groceries and gas could help you earn a lot. However, PLOCs don’t come with benefits like this.

Want to learn more? Read “Line of Credit vs. Credit Card: Which Is Right for Me?”

Personal loan

If you have a one-time need for money and know how much that’ll be, a personal loan may be for you.

A personal loan will give you a lump sum of money that you’ll pay back in monthly installments, plus interest. Interest rates are fixed, so they stay the same as you pay back your loan.

Since it comes as a lump sum, a personal loan can help you avoid racking up too much debt. You’ll pay interest on the entire loan, but it isn’t something you can borrow from more than once.

Want to learn more? Read “Line of Credit vs. Personal Loan: Which Is Right for Me?”

Home equity line of credit (HELOC)

Homeowners considering a PLOC might want to check out a HELOC instead. HELOCs tend to have lower rates — but they’re also riskier, since they use your house as collateral.

A home equity line of credit (HELOC) is like a personal line of credit, with one major difference: HELOCs use your home as collateral. Since a HELOC is secured, it usually has a lower interest rate than unsecured personal lines of credit.

HELOCs can be risky, however. If you don’t pay it back, the lender can foreclose on your house.

Want to learn more? Read “What Is a HELOC? Home Equity Lines of Credit Explained”

What sets LendingTree content apart

Expert

Our personal loan writers and editors have 32 years of combined editorial experience and 28 years of combined personal finance experience.

Verified

100% of our content is reviewed by certified personal finance professionals and meets compliance and legal standards.

Trustworthy

We put your interests first. We’ll tell you about any loan drawbacks and be clear about when to consider alternatives.

Frequently asked questions

It’s possible to get a personal line of credit with bad credit, but you’ll probably have to look online. Bad credit PLOCs often come with high rates and fees. NetCredit, for example, offers bad credit PLOCs but charges a 10% fee every time you use your line — that’s $100 out of every $1,000 you borrow.

Traditional PLOCs are usually offered by banks, which tend to require at least good credit (670+).

Compared to other types of financing, personal lines are heavy on fees. Your personal line of credit could include:

- Application fees: These aren’t common and can be a sign of predatory lending.

- Origination fees: When you open your line of credit, your lender could charge a percentage of your line as an origination fee.

- Annual or monthly fees: You may need to pay a maintenance fee every year or month that your line of credit is open.

- Late payment fees: Budget for a possible fee if you pay late.

- Over-limit fees: If you charge past your credit limit, that could be another fee.

- Cash equivalent fees: Some lenders charge when you use your PLOC card to pay for things directly (as opposed to doing an online transfer into your checking account).

- Cash advance ATM fees: You might be able to tap your PLOC using an ATM, but it will probably come with a fee.

- Foreign transaction fees: These can apply to foreign purchases or if you use an ATM overseas to get foreign currency.

When you’re comparing offers for personal lines of credit, pay special attention to:

- APRs: Your APR measures the cost of your PLOC, including interest and fees. The higher the APR, the more expensive the PLOC.

- Draw/repayment period: Most PLOCs have a continuous draw period, which means there’s no end date to your borrowing. However, some lenders have specific draw periods and specific repayment periods. These dictate when you can borrow and when you have to start paying off any remaining balance left on your line.

- Line amounts: Some PLOCs are small, some are big. If you don’t need a lot of money, make sure that you meet the lender’s minimum line requirement. The same goes for big loans; instead, make sure the lender can provide the amount you need.

- Fees: PLOCs have more fees compared to some other types of loans (including personal loans). Ask for a breakdown of fees to make sure the PLOC is actually worth it.

- Ease of use: Does the PLOC come with a card or just checks?

- Customer complaints: The Consumer Financial Protection Bureau maintains a database of database of complaints against lenders. Before signing a contract, check it to make sure the company is legit.