Renting Is Cheaper Than Owning in Every Large Metro

Choosing between renting and buying a home can be challenging, especially in competitive markets.

Renting might be better for someone who doesn’t plan to stay long in one area or is looking for short-term savings. Conversely, buying a home can be a valuable investment that’s cheaper in the long term.

Cost is a massive factor to consider when choosing between renting and buying. Because of this, LendingTree analyzed U.S. Census Bureau data to compare monthly rent and housing costs for homes with a mortgage in the 100 largest U.S. metros. In each, median rent costs are lower than median housing costs for those with a mortgage.

Key findings

- If you’re paying off a mortgage, renting is likely cheaper than owning. In the U.S., the difference between median gross rent ($1,406) and median housing costs ($1,904) for homes with a mortgage was $498 a month in 2023 — $23 more than the $475 difference ($1,300 and $1,775) in 2022.

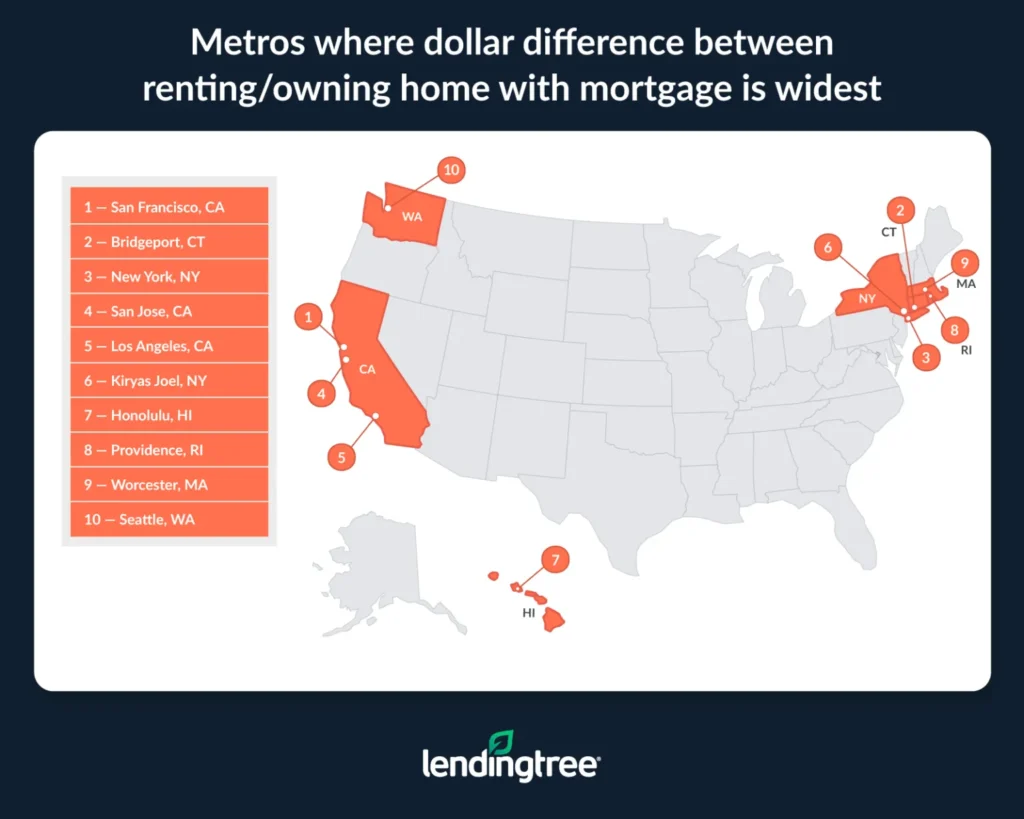

- The dollar difference between renting and owning a home with a mortgage is widest in the San Francisco, Bridgeport, Conn., and New York metros. The difference between median monthly gross rent and median monthly housing costs for homes with a mortgage in these metros in 2023 was $1,414, $1,367 and $1,340, respectively.

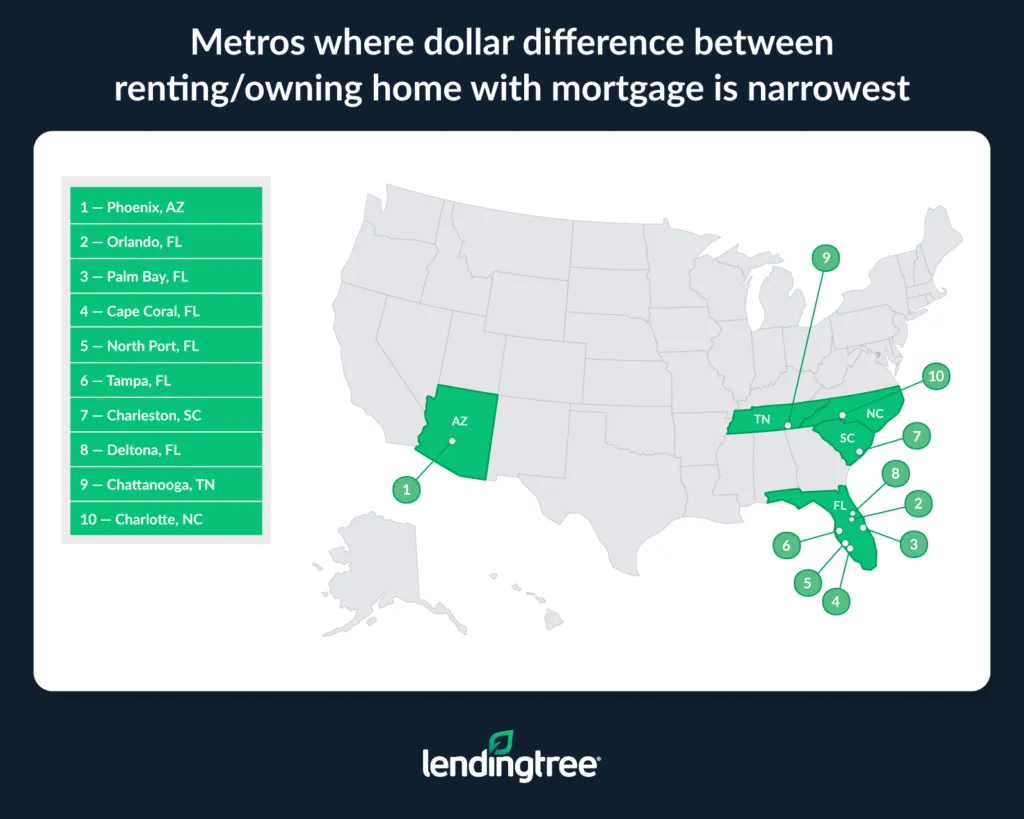

- Phoenix, Orlando, Fla., and Palm Bay, Fla., have the narrowest gaps between renting and owning a home with a mortgage. In these metros, median gross rent costs in 2023 were $90, $127 and $128 less monthly than median housing costs for homes with a mortgage. Six of the 10 metros with the narrowest gaps were in Florida.

- The percentage difference between median gross rent and median housing costs for homes with a mortgage is greatest in New York, Bridgeport and Providence, R.I. In these metros, renters pay 76.0%, 73.4% and 66.6% less, respectively. San Francisco drops to 10th by percentage despite having the largest dollar difference.

Metros where dollar difference between renting/owning home with mortgage is widest

No. 1: San Francisco

- Median monthly gross rent: $2,397

- Median monthly housing costs for homes with a mortgage: $3,811

- Difference: $1,414

No. 2: Bridgeport, Conn.

- Median monthly gross rent: $1,862

- Median monthly housing costs for homes with a mortgage: $3,229

- Difference: $1,367

No. 3: New York

- Median monthly gross rent: $1,764

- Median monthly housing costs for homes with a mortgage: $3,104

- Difference: $1,340

Metros where dollar difference between renting/owning home with mortgage is narrowest

No. 1: Phoenix

- Median monthly gross rent: $1,760

- Median monthly housing costs for homes with a mortgage: $1,850

- Difference: $90

No. 2: Orlando, Fla.

- Median monthly gross rent: $1,799

- Median monthly housing costs for homes with a mortgage: $1,926

- Difference: $127

No. 3: Palm Bay, Fla.

- Median monthly gross rent: $1,648

- Median monthly housing costs for homes with a mortgage: $1,776

- Difference: $128

Renting vs. owning: Widest to narrowest monthly gaps by $

| Rank | Metro | Median rent | Median housing costs for homes with mortgage | Difference ($) |

|---|---|---|---|---|

| 1 | San Francisco, CA | $2,397 | $3,811 | $1,414 |

| 2 | Bridgeport, CT | $1,862 | $3,229 | $1,367 |

| 3 | New York, NY | $1,764 | $3,104 | $1,340 |

| 4 | San Jose, CA | $2,773 | At least $4,000 | $1,227 |

| 5 | Los Angeles, CA | $1,993 | $3,096 | $1,103 |

| 6 | Kiryas Joel, NY | $1,610 | $2,526 | $916 |

| 7 | Honolulu, HI | $2,033 | $2,933 | $900 |

| 8 | Providence, RI | $1,330 | $2,216 | $886 |

| 9 | Worcester, MA | $1,449 | $2,329 | $880 |

| 10 | Seattle, WA | $1,965 | $2,839 | $874 |

| 11 | Boston, MA | $2,000 | $2,863 | $863 |

| 12 | Hartford, CT | $1,397 | $2,237 | $840 |

| 13 | New Haven, CT | $1,471 | $2,290 | $819 |

| 14 | San Diego, CA | $2,296 | $3,076 | $780 |

| 15 | Oxnard, CA | $2,264 | $3,025 | $761 |

| 16 | Houston, TX | $1,433 | $2,193 | $760 |

| 17 | Sacramento, CA | $1,800 | $2,536 | $736 |

| 17 | Stockton, CA | $1,655 | $2,391 | $736 |

| 19 | Madison, WI | $1,335 | $2,070 | $735 |

| 20 | Washington, DC | $1,945 | $2,679 | $734 |

| 21 | Chicago, IL | $1,390 | $2,112 | $722 |

| 22 | Dallas, TX | $1,638 | $2,358 | $720 |

| 23 | New Orleans, LA | $1,159 | $1,869 | $710 |

| 24 | Omaha, NE | $1,168 | $1,877 | $709 |

| 25 | Austin, TX | $1,752 | $2,450 | $698 |

| 26 | Milwaukee, WI | $1,122 | $1,795 | $673 |

| 27 | Portland, OR | $1,670 | $2,335 | $665 |

| 28 | Philadelphia, PA | $1,456 | $2,091 | $635 |

| 29 | Minneapolis, MN | $1,427 | $2,042 | $615 |

| 30 | Bakersfield, CA | $1,286 | $1,896 | $610 |

| 31 | Albany, NY | $1,293 | $1,896 | $603 |

| 32 | San Antonio, TX | $1,342 | $1,936 | $594 |

| 33 | Wichita, KS | $965 | $1,551 | $586 |

| 34 | Denver, CO | $1,898 | $2,474 | $576 |

| 35 | Baltimore, MD | $1,557 | $2,128 | $571 |

| 36 | Des Moines, IA | $1,137 | $1,706 | $569 |

| 37 | Fresno, CA | $1,418 | $1,982 | $564 |

| 38 | Kansas City, MO | $1,240 | $1,798 | $558 |

| 39 | Riverside, CA | $1,850 | $2,403 | $553 |

| 40 | Cincinnati, OH | $1,101 | $1,644 | $543 |

| 41 | Spokane, WA | $1,279 | $1,821 | $542 |

| 42 | Provo, UT | $1,556 | $2,086 | $530 |

| 43 | Oklahoma City, OK | $1,140 | $1,669 | $529 |

| 44 | Buffalo, NY | $1,054 | $1,572 | $518 |

| 45 | Miami, FL | $1,914 | $2,424 | $510 |

| 46 | Columbus, OH | $1,254 | $1,757 | $503 |

| 47 | Tulsa, OK | $1,075 | $1,575 | $500 |

| 48 | Syracuse, NY | $1,067 | $1,566 | $499 |

| 49 | McAllen, TX | $936 | $1,434 | $498 |

| 50 | Cleveland, OH | $1,032 | $1,525 | $493 |

| 51 | Allentown, PA | $1,347 | $1,839 | $492 |

| 52 | St. Louis, MO | $1,102 | $1,592 | $490 |

| 53 | Pittsburgh, PA | $1,044 | $1,533 | $489 |

| 54 | Detroit, MI | $1,183 | $1,661 | $478 |

| 55 | Harrisburg, PA | $1,195 | $1,665 | $470 |

| 56 | El Paso, TX | $1,127 | $1,596 | $469 |

| 57 | Toledo, OH | $927 | $1,392 | $465 |

| 58 | Baton Rouge, LA | $1,100 | $1,551 | $451 |

| 59 | Salt Lake City, UT | $1,639 | $2,086 | $447 |

| 60 | Rochester, NY | $1,138 | $1,584 | $446 |

| 61 | Virginia Beach, VA | $1,465 | $1,901 | $436 |

| 62 | Louisville, KY | $1,083 | $1,507 | $424 |

| 63 | Dayton, OH | $1,027 | $1,445 | $418 |

| 64 | Jackson, MS | $1,023 | $1,439 | $416 |

| 65 | Ogden, UT | $1,528 | $1,926 | $398 |

| 66 | Colorado Springs, CO | $1,706 | $2,103 | $397 |

| 67 | Scranton, PA | $1,057 | $1,449 | $392 |

| 68 | Akron, OH | $1,029 | $1,417 | $388 |

| 69 | Memphis, TN | $1,200 | $1,586 | $386 |

| 70 | Little Rock, AR | $1,031 | $1,412 | $381 |

| 71 | Birmingham, AL | $1,153 | $1,513 | $360 |

| 72 | Augusta, GA | $1,101 | $1,449 | $348 |

| 72 | Durham, NC | $1,532 | $1,880 | $348 |

| 74 | Indianapolis, IN | $1,207 | $1,554 | $347 |

| 74 | Lakeland, FL | $1,403 | $1,750 | $347 |

| 76 | Tucson, AZ | $1,263 | $1,603 | $340 |

| 77 | Albuquerque, NM | $1,203 | $1,539 | $336 |

| 78 | Winston-Salem, NC | $994 | $1,327 | $333 |

| 79 | Grand Rapids, MI | $1,207 | $1,529 | $322 |

| 80 | Richmond, VA | $1,491 | $1,805 | $314 |

| 81 | Raleigh, NC | $1,605 | $1,916 | $311 |

| 82 | Boise, ID | $1,511 | $1,802 | $291 |

| 83 | Greenville, SC | $1,168 | $1,455 | $287 |

| 84 | Knoxville, TN | $1,170 | $1,447 | $277 |

| 85 | Nashville, TN | $1,566 | $1,839 | $273 |

| 86 | Greensboro, NC | $1,103 | $1,375 | $272 |

| 87 | Jacksonville, FL | $1,564 | $1,832 | $268 |

| 88 | Las Vegas, NV | $1,654 | $1,891 | $237 |

| 89 | Atlanta, GA | $1,701 | $1,923 | $222 |

| 90 | Columbia, SC | $1,169 | $1,383 | $214 |

| 91 | Charlotte, NC | $1,505 | $1,715 | $210 |

| 92 | Chattanooga, TN | $1,214 | $1,413 | $199 |

| 93 | Deltona, FL | $1,516 | $1,712 | $196 |

| 94 | Charleston, SC | $1,641 | $1,827 | $186 |

| 95 | Tampa, FL | $1,729 | $1,910 | $181 |

| 96 | North Port, FL | $1,854 | $2,007 | $153 |

| 97 | Cape Coral, FL | $1,797 | $1,944 | $147 |

| 98 | Palm Bay, FL | $1,648 | $1,776 | $128 |

| 99 | Orlando, FL | $1,799 | $1,926 | $127 |

| 100 | Phoenix, AZ | $1,760 | $1,850 | $90 |

Metros where percentage difference between renting/owning home with mortgage is highest

No. 1: New York

- Median monthly gross rent: $1,764

- Median monthly housing costs for homes with a mortgage: $3,104

- Difference: 76.0%

No. 2: Bridgeport, Conn.

- Median monthly gross rent: $1,862

- Median monthly housing costs for homes with a mortgage: $3,229

- Difference: 73.4%

No. 3: Providence, R.I.

- Median monthly gross rent: $1,330

- Median monthly housing costs for homes with a mortgage: $2,216

- Difference: 66.6%

Metros where percentage difference between renting/owning home with mortgage is lowest

No. 1: Phoenix

- Median monthly gross rent: $1,760

- Median monthly housing costs for homes with a mortgage: $1,850

- Difference: 5.1%

No. 2: Orlando, Fla.

- Median monthly gross rent: $1,799

- Median monthly housing costs for homes with a mortgage: $1,926

- Difference: 7.1%

No. 3: Palm Bay, Fla.

- Median monthly gross rent: $1,648

- Median monthly housing costs for homes with a mortgage: $1,776

- Difference: 7.8%

Renting vs. owning: Highest to lowest monthly gaps by %

| Rank | Metro | Median rent | Median housing costs for homes with mortgage | Difference (%) |

|---|---|---|---|---|

| 1 | New York, NY | $1,764 | $3,104 | 76.0% |

| 2 | Bridgeport, CT | $1,862 | $3,229 | 73.4% |

| 3 | Providence, RI | $1,330 | $2,216 | 66.6% |

| 4 | New Orleans, LA | $1,159 | $1,869 | 61.3% |

| 5 | Omaha, NE | $1,168 | $1,877 | 60.7% |

| 5 | Wichita, KS | $965 | $1,551 | 60.7% |

| 5 | Worcester, MA | $1,449 | $2,329 | 60.7% |

| 8 | Hartford, CT | $1,397 | $2,237 | 60.1% |

| 9 | Milwaukee, WI | $1,122 | $1,795 | 60.0% |

| 10 | San Francisco, CA | $2,397 | $3,811 | 59.0% |

| 11 | Kiryas Joel, NY | $1,610 | $2,526 | 56.9% |

| 12 | New Haven, CT | $1,471 | $2,290 | 55.7% |

| 13 | Los Angeles, CA | $1,993 | $3,096 | 55.3% |

| 14 | Madison, WI | $1,335 | $2,070 | 55.1% |

| 15 | McAllen, TX | $936 | $1,434 | 53.2% |

| 16 | Houston, TX | $1,433 | $2,193 | 53.0% |

| 17 | Chicago, IL | $1,390 | $2,112 | 51.9% |

| 18 | Toledo, OH | $927 | $1,392 | 50.2% |

| 19 | Des Moines, IA | $1,137 | $1,706 | 50.0% |

| 20 | Cincinnati, OH | $1,101 | $1,644 | 49.3% |

| 21 | Buffalo, NY | $1,054 | $1,572 | 49.1% |

| 22 | Cleveland, OH | $1,032 | $1,525 | 47.8% |

| 23 | Bakersfield, CA | $1,286 | $1,896 | 47.4% |

| 24 | Pittsburgh, PA | $1,044 | $1,533 | 46.8% |

| 24 | Syracuse, NY | $1,067 | $1,566 | 46.8% |

| 26 | Albany, NY | $1,293 | $1,896 | 46.6% |

| 27 | Tulsa, OK | $1,075 | $1,575 | 46.5% |

| 28 | Oklahoma City, OK | $1,140 | $1,669 | 46.4% |

| 29 | Kansas City, MO | $1,240 | $1,798 | 45.0% |

| 30 | Seattle, WA | $1,965 | $2,839 | 44.5% |

| 30 | St. Louis, MO | $1,102 | $1,592 | 44.5% |

| 30 | Stockton, CA | $1,655 | $2,391 | 44.5% |

| 33 | Honolulu, HI | $2,033 | $2,933 | 44.3% |

| 33 | San Antonio, TX | $1,342 | $1,936 | 44.3% |

| 35 | San Jose, CA | $2,773 | At least $4,000 | 44.2% |

| 36 | Dallas, TX | $1,638 | $2,358 | 44.0% |

| 37 | Philadelphia, PA | $1,456 | $2,091 | 43.6% |

| 38 | Boston, MA | $2,000 | $2,863 | 43.2% |

| 39 | Minneapolis, MN | $1,427 | $2,042 | 43.1% |

| 40 | Spokane, WA | $1,279 | $1,821 | 42.4% |

| 41 | El Paso, TX | $1,127 | $1,596 | 41.6% |

| 42 | Baton Rouge, LA | $1,100 | $1,551 | 41.0% |

| 43 | Sacramento, CA | $1,800 | $2,536 | 40.9% |

| 44 | Dayton, OH | $1,027 | $1,445 | 40.7% |

| 44 | Jackson, MS | $1,023 | $1,439 | 40.7% |

| 46 | Detroit, MI | $1,183 | $1,661 | 40.4% |

| 47 | Columbus, OH | $1,254 | $1,757 | 40.1% |

| 48 | Austin, TX | $1,752 | $2,450 | 39.8% |

| 48 | Fresno, CA | $1,418 | $1,982 | 39.8% |

| 48 | Portland, OR | $1,670 | $2,335 | 39.8% |

| 51 | Harrisburg, PA | $1,195 | $1,665 | 39.3% |

| 52 | Louisville, KY | $1,083 | $1,507 | 39.2% |

| 52 | Rochester, NY | $1,138 | $1,584 | 39.2% |

| 54 | Akron, OH | $1,029 | $1,417 | 37.7% |

| 54 | Washington, DC | $1,945 | $2,679 | 37.7% |

| 56 | Scranton, PA | $1,057 | $1,449 | 37.1% |

| 57 | Little Rock, AR | $1,031 | $1,412 | 37.0% |

| 58 | Baltimore, MD | $1,557 | $2,128 | 36.7% |

| 59 | Allentown, PA | $1,347 | $1,839 | 36.5% |

| 60 | Provo, UT | $1,556 | $2,086 | 34.1% |

| 61 | San Diego, CA | $2,296 | $3,076 | 34.0% |

| 62 | Oxnard, CA | $2,264 | $3,025 | 33.6% |

| 63 | Winston-Salem, NC | $994 | $1,327 | 33.5% |

| 64 | Memphis, TN | $1,200 | $1,586 | 32.2% |

| 65 | Augusta, GA | $1,101 | $1,449 | 31.6% |

| 66 | Birmingham, AL | $1,153 | $1,513 | 31.2% |

| 67 | Denver, CO | $1,898 | $2,474 | 30.3% |

| 68 | Riverside, CA | $1,850 | $2,403 | 29.9% |

| 69 | Virginia Beach, VA | $1,465 | $1,901 | 29.8% |

| 70 | Indianapolis, IN | $1,207 | $1,554 | 28.7% |

| 71 | Albuquerque, NM | $1,203 | $1,539 | 27.9% |

| 72 | Salt Lake City, UT | $1,639 | $2,086 | 27.3% |

| 73 | Tucson, AZ | $1,263 | $1,603 | 26.9% |

| 74 | Grand Rapids, MI | $1,207 | $1,529 | 26.7% |

| 75 | Miami, FL | $1,914 | $2,424 | 26.6% |

| 76 | Ogden, UT | $1,528 | $1,926 | 26.0% |

| 77 | Greensboro, NC | $1,103 | $1,375 | 24.7% |

| 77 | Lakeland, FL | $1,403 | $1,750 | 24.7% |

| 79 | Greenville, SC | $1,168 | $1,455 | 24.6% |

| 80 | Knoxville, TN | $1,170 | $1,447 | 23.7% |

| 81 | Colorado Springs, CO | $1,706 | $2,103 | 23.3% |

| 82 | Durham, NC | $1,532 | $1,880 | 22.7% |

| 83 | Richmond, VA | $1,491 | $1,805 | 21.1% |

| 84 | Raleigh, NC | $1,605 | $1,916 | 19.4% |

| 85 | Boise, ID | $1,511 | $1,802 | 19.3% |

| 86 | Columbia, SC | $1,169 | $1,383 | 18.3% |

| 87 | Nashville, TN | $1,566 | $1,839 | 17.4% |

| 88 | Jacksonville, FL | $1,564 | $1,832 | 17.1% |

| 89 | Chattanooga, TN | $1,214 | $1,413 | 16.4% |

| 90 | Las Vegas, NV | $1,654 | $1,891 | 14.3% |

| 91 | Charlotte, NC | $1,505 | $1,715 | 14.0% |

| 92 | Atlanta, GA | $1,701 | $1,923 | 13.1% |

| 93 | Deltona, FL | $1,516 | $1,712 | 12.9% |

| 94 | Charleston, SC | $1,641 | $1,827 | 11.3% |

| 95 | Tampa, FL | $1,729 | $1,910 | 10.5% |

| 96 | North Port, FL | $1,854 | $2,007 | 8.3% |

| 97 | Cape Coral, FL | $1,797 | $1,944 | 8.2% |

| 98 | Palm Bay, FL | $1,648 | $1,776 | 7.8% |

| 99 | Orlando, FL | $1,799 | $1,926 | 7.1% |

| 100 | Phoenix, AZ | $1,760 | $1,850 | 5.1% |

Is it better to rent or own?

If you’re struggling with the decision to rent or buy a home, there’s no right or wrong answer. Carefully consider your budget, lifestyle and financial goals to help you choose your best option.

Below are some considerations to help you decide.

Consider renting if …

- You can’t afford a loan at today’s rates. Mortgage rates are hovering just below 7.00%, while median home prices remain steady above $400,000. Because rent payments tend to be cheaper than mortgage payments, renting can be good (at least in the short term) for those who would struggle to keep up with a mortgage at today’s rates and prices.

- You don’t have enough cash for a down payment. Even if you could hypothetically afford your payments, you may struggle to get a mortgage if you don’t have the money for a down payment. The upfront costs of renting — like a security deposit or broker’s fee — are likely much more affordable.

- You don’t plan to live in the home for very long. Buying a home is typically a long-term investment. If you don’t plan to stay in an area long term or want the freedom to pick up and move for a new job or change of pace, you may be better off renting.

- You don’t want the hassle and expense of maintaining a home. Buying a home involves more than the mortgage payment. If you don’t want to be saddled with covering maintenance and repairs, renting will put that responsibility on your landlord’s shoulders.

Consider buying if …

- You want an investment for the future. Although buying a home can be expensive, it can also be a good long-term investment. Unlike renters, homeowners can build home equity by making their mortgage payments and may be able to sell their homes for a profit at some point.

- You think you could benefit from certain tax benefits. Homeowners can qualify for tax deductions to help lower their federal tax bill. For example, you can deduct the interest paid on up to $750,000 of mortgage debt if you’re an individual taxpayer or a married couple filing a joint tax return ($375,000 for a married couple filing separately). Other potential tax breaks include deductions for mortgage points and property taxes.

- You want more freedom over your space. When you rent, you’re ultimately beholden to a landlord’s rules. This might mean you can’t remodel, paint or do basic maintenance without approval. As a homeowner, you’ll be allowed to modify your home however you see fit, so long as you aren’t breaking any laws or violating homeowners association (HOA) rules.

- You’re financially secure. While many perks can come with being a homeowner, they’re unlikely to matter to someone struggling with their finances and facing default on their mortgage. As a result, you should only consider buying a home if you’re reasonably sure you can afford it.

Methodology

LendingTree analyzed the U.S. Census Bureau 2023 and 2022 American Community Surveys with one-year estimates to determine the median costs to rent and own a home in the nation’s 100 largest metropolitan statistical areas (MSAs).

The housing cost variables used in this study — median monthly gross rent and median monthly housing costs with a mortgage — include the total monthly cost that renters or owners incur, including utilities, fees and/or taxes.

View mortgage loan offers from up to 5 lenders in minutes

Recommended Articles