Nearly Half of Homeowners Are Moving to a New Home in the 2020’s

A major share of homeowners has a new home purchase in mind in the coming years. Another group of them plan to go back to the days of having a landlord and fewer residential responsibilities, according to results from a new LendingTree survey.

LendingTree commissioned the survey of more than 1,500 Americans to better understand their sentiments around making moves in this new decade, whether it’s buying a home or choosing to rent.

Key findings

45% of homeowners have plans to move at some point within this decade

Of those homeowners, 16% said they’re moving to a new house in their current city, roughly 15% are moving to a new city in their state and nearly 15% are relocating to a new state. However, more than 1 in 5 (22%) homeowners aren’t sure about their moving plans over the next 10 years.

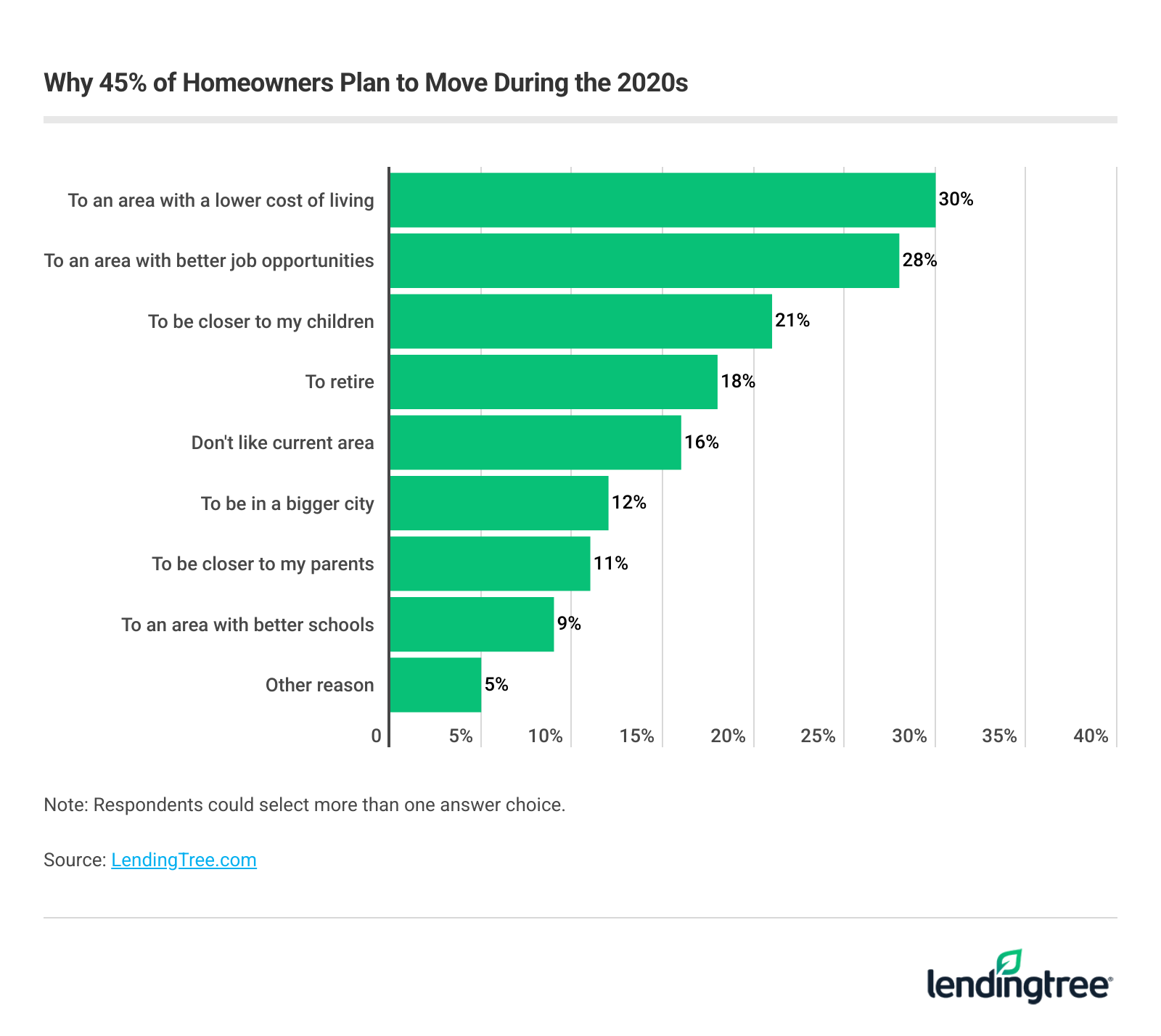

When homeowners with moving plans were asked why they’re making moves, the top three responses were:

- To move to an area with a lower cost of living (30%)

- To move to an area with better job prospects (28%)

- To be closer to their children (21%)

More than 1 in 4 millennials are considering a return to renting

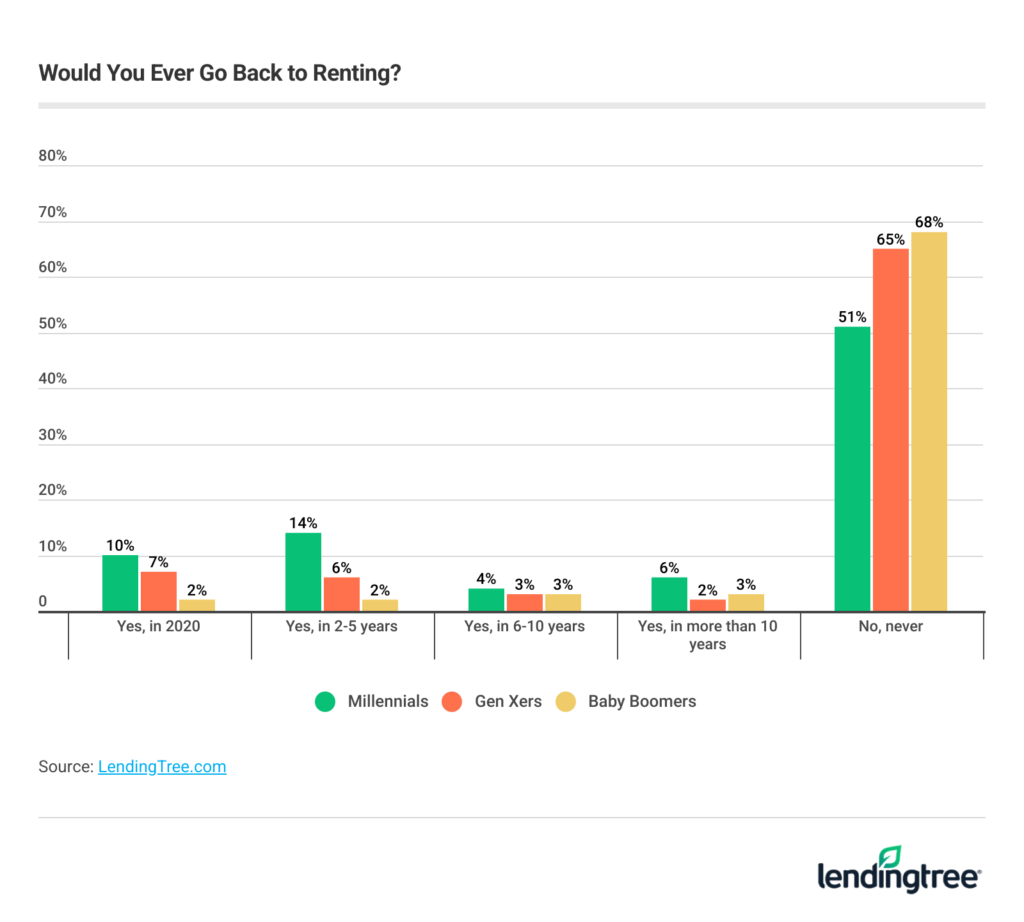

Not all millennial homeowners seem to be sold on ownership. More than a quarter (28%) of them plan to go back to renting sometime this decade. Just 7% of baby boomers plan to do the same.

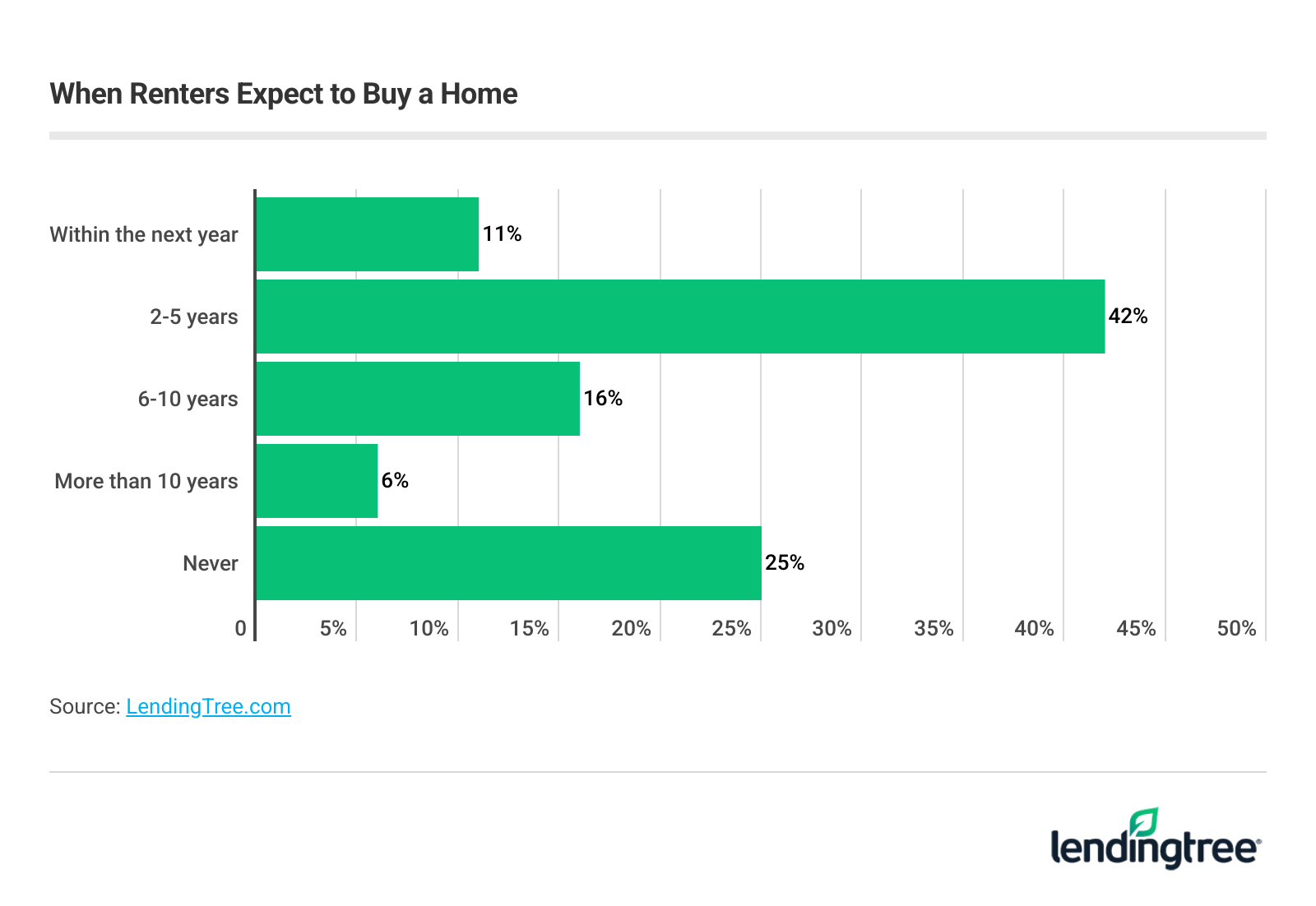

About 1 in 10 (11%) renters are planning to buy a home in 2020

Another 42% of renters have plans to buy a home within the next two to five years and nearly 16% expect they’ll start the homebuying process in the next six to 10 years.

Conversely, 1 in 4 renters said they never plan to buy a home.

Other takeaways

The top five reasons current homeowners would buy a new house in the next 10 years are:

- Retiring to a new area (16%)

- Moving to a larger home (14%)

- Downsizing as empty nesters (12%)

- Upgrading from a starter home (10%)

- Job relocation (10%)

For millennial homeowners, the most-cited reason is moving to a larger home (26%). The top reason for both Gen Xers (19%) and baby boomers (26%) is retiring to a new area.

Nearly 60% of homeowners in the silent generation said there’s absolutely no reason they would buy a new home within the next decade. More than 1 in 3 (35%) baby boomers agree.

About 1 in 6 homeowners plan to return to renting at some point over the next 10 years. One in 10 millennials plan to rent again in 2020. More than two-thirds (68%) of baby boomers don’t plan to ever go back to renting.

When asked if they plan to downsize their home in the next five years, 18% of homeowners said yes. Another 23% said downsizing is a possibility for them.

Additionally, more than 1 in 5 (21%) of homeowners plan to move to a larger home in the next five years.

How to prepare for your next move

Whether you’re planning to downsize or upsize your home, here are tips to prepare for homebuying and selling processes.

- Before you go house hunting, get a mortgage preapproval to understand how much house you may be able to afford. Then, go find your dream home.

- A new home likely means you’ll need a new mortgage and want to get your best mortgage rate. Keep your credit scores high and outstanding debt low, and make more than the minimum down payment. Don’t forget to comparison shop for your best mortgage.

- While you’re preparing to buy your next home, get ready to sell your current home by finishing any incomplete home improvement projects, decluttering and staging for buyers. You might also consider getting a home appraisal to ensure you set a reasonable listing price.

Methodology

For this survey, LendingTree commissioned Qualtrics to conduct an online survey of 1,552 Americans with the sample base proportioned to represent the overall population. The survey was fielded Dec. 13-16, 2019.

LendingTree defined generations* by the following age ranges:

- Millennials: ages 23-38

- Generation X: ages 39-53

- Baby boomers: ages 54-73

*Survey responses from members of Generation Z (ages 18-22) and the Silent Generation (ages 74+) were also included in the total percentages among all respondents. However, their responses are excluded from the graphics and age breakdowns, due to the smaller population size among our survey sample.

View mortgage loan offers from up to 5 lenders in minutes