Best Egg Personal Loan Review

- APR

- 6.99% – 35.99%

The Annual Percentage Rate (APR) is the cost of credit as a yearly rate and ranges from 5.99% to 29.99%, which may include an origination fee from 0.99% – 6.99% that is deducted from loan proceeds. Any origination fee on a loan term 4-years or longer will be at least 4.99%. The loan term and the APR offered will depend on your credit score, income, debt payment obligations, loan amount, credit usage history and other factors. Additionally, the APR offered is impacted by your loan term and may be higher than our lowest advertised rate. Requests for the highest loan amount may result in an APR higher than our lowest advertised rate. You need a minimum 700 FICO® score and a minimum individual annual income of $100,000 to qualify for our lowest rate.

Best Egg loans are unsecured personal loans made by Cross River Bank, a New Jersey State Chartered Commercial Bank, Member FDIC. “Best Egg” is a trademark of Marlette Funding, LLC. All uses of “Best Egg” refer to “the Best Egg personal loan” and/or “Best Egg on behalf of Cross River Bank, as originator of the Best Egg personal loan,” as applicable. The term, amount and APR of any loan we offer to you will depend on your credit score, income, debt payment obligations, loan amount, credit history and other factors. Your loan agreement will contain specific terms and conditions. The timing of available funds upon loan approval may vary depending upon your bank’s policies. Loan amounts range from $2,000–$50,000. Residents of Massachusetts have a minimum loan amount of $6,500 ; New Mexico and Ohio, $5,000; and Georgia, $3,000. For a second Best Egg loan, your total existing Best Egg loan balances cannot exceed $50,000. Annual Percentage Rates (APRs) range from 5.99%–29.99%. The APR is the cost of credit as a yearly rate and reflects both your interest rate and an origination fee of 0.99%–6.99% of your loan amount, which will be deducted from any loan proceeds you receive. The origination fee on a loan term 4-years or longer will be at least 4.99%. Your loan term will impact your APR, which may be higher than our lowest advertised rate. You need a minimum 700 FICO® score and a minimum individual annual income of $100,000 to qualify for our lowest APR.

To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you.

QA Test

QA Test

QA Test

test

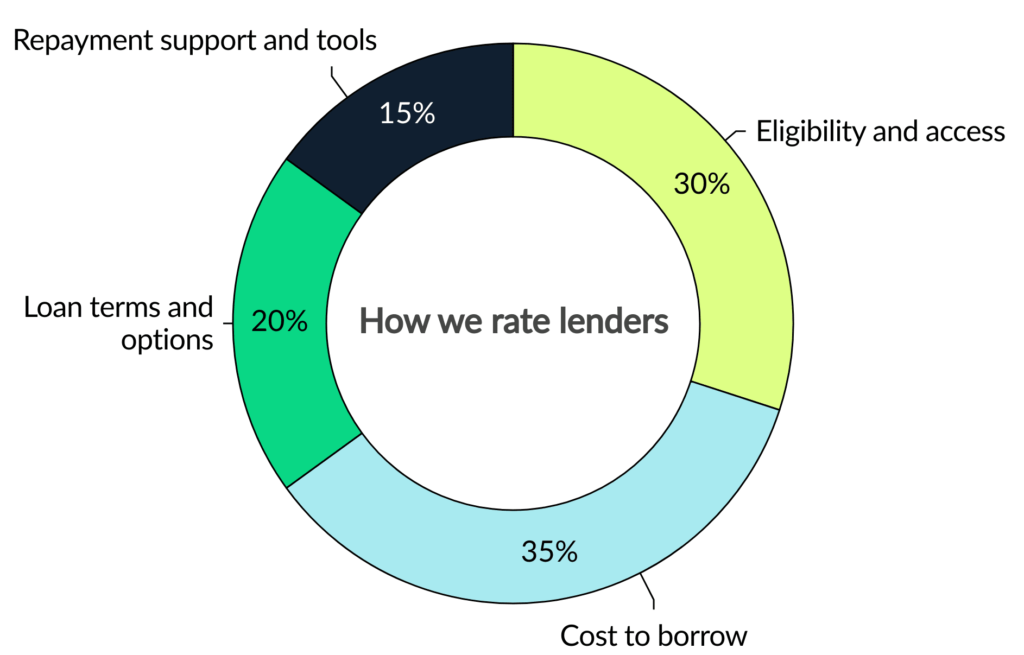

- Eligibility and access: 5/5

- Cost to borrow: 3.2/5

- Loan terms and options: 5/5

- Repayment support and tools: 5/5

- Secured loans available: Best Egg offers two kinds of secured loans. With one, you’ll use your vehicle’s equity as collateral. With the other, your home’s permanent fixtures will secure the loan.

- Fast funding: Best Egg offers some of the quickest loans on the market. You could get your loan one to three business days after Best Egg approves you.

- No mobile app for loans: Best Egg ’s mobile app only allows you to make payments on Best Egg credit cards.

- Flexible payments: In most cases, Best Egg will allow you to postpone up to two payments over the life of your loan.

- Mandatory origination fee: No matter your credit, Best Egg charges an upfront origination fee of . Best Egg takes this fee out of your loan money before sending it to you.

- Will directly pay your creditors: Best Egg ’s Direct Pay benefit can streamline debt consolidation.

- Best for borrowers with excellent credit and a high annual income: Best Egg ’s starting rates are competitive, but you’ll need a credit score of 700+ and an annual income of at least $100,000 to qualify for them.

Best Egg pros and cons

Like every lender, Best Egg has its pros and cons — explore them here.

Pros

- Can prequalify with a soft credit check

- Competitive starting rates

- Can use collateral to get lower rates

- Live chat available for customer service

Cons

- Must have excellent credit and high income to get lowest rates

- Charges an origination fee

- Can’t apply for a loan with another person

- No discount for automatic payments

One of Best Egg ’s standout features is its secured loans. If you offer your home’s permanent fixtures as collateral, you could qualify for a substantial APR discount. Permanent fixtures could be built-in cabinetry, vanities, light fixtures and the like.

If you’re not a homeowner, you can use your car as collateral with an auto equity loan. But you risk losing your collateral if you stop making payments on a secured loan.

If you prefer an unsecured personal loan, Best Egg offers those, too.

Although Best Egg offers loans for fair credit, you’ll face an APR as high as 35.99%. Even those with a strong FICO score may find it hard to get Best Egg ’s lowest rates thanks to its income requirements.

Best Egg requirements

Before pursuing Best Egg , make sure you’re eligible.

Personal loan requirements vary by lender. Best Egg will review factors like your debt-to-income ratio and credit history. You’ll also need to meet the guidelines below.

| Age | Be of legal age to accept a loan in your state (typically age 18 or older) |

| Minimum credit score | 580 |

| Residency | Best Egg

loans are not available in:

|

| Administrative | Have a valid email address, checking account and physical address (not just a PO Box) |

| Minimum income | Best Egg doesn’t disclose its general minimum income requirement, but you must earn at least $100,000 a year for the lowest rates. |

If you meet the basic requirements listed above, you’ll likely need to tell Best Egg how you plan to use your personal loan. While Best Egg does allow borrowers to use loan money for a variety of purposes, there are certain ways you can’t use the money.

Best Egg loans CAN be used for…

- Debt consolidation

- Credit card refinancing

- Home improvement

- Medical expenses

- Moving expenses

- Vacations

- Taxes

- Major purchases

Best Egg loans CANNOT be used for…

- College or graduate school expenses

- Carrying or buying securities (stocks, bonds or other tradable investments)

- Illegal activity

If Best Egg ’s loan options won’t work for your borrowing needs, be sure to shop around for a lender that helps you meet your financial goals and can offer you the best-fitting rates, terms and amounts.

How to get a personal loan with Best Egg

Getting a personal loan from Best Egg is straightforward. Here’s how to go about it.

Prequalify

Prequalifying for a personal loan with Best Egg is simple. Best Egg will ask for some basic information, such as your name and phone number. You will also need to provide some financial details, like your income.

You need a credit score of at least 580 to qualify for Best Egg . If you’re concerned your credit score will disqualify you, you can work on boosting your personal loan approval odds.

Formally apply

Best Egg should let you know if you passed prequalification in a few minutes. Then, you can submit a formal loan application online or over the phone.

Applying for a loan is similar to prequalification, but you’ll need to provide more information about your finances. For instance, Best Egg will ask how many cash advances you’ve taken in the last six months.

You may also need to send Best Egg documents like a pay stub or utility bill. You can do this via Best Egg ’s online portal, as well as by text, email or fax. It may take two to three business days for Best Egg to review your documents, which could impact your funding timeline.

Finally, Best Egg will run a hard credit pull, so don’t be alarmed when it asks for your Social Security number.

Review your offers

If Best Egg approves you, it may send you several loan offers with different terms and loan amounts. Review these carefully. You may want to choose the shortest loan term you can. If you do, you may pay less overall interest.

Sign your loan documents

Once you’ve chosen the right loan for you, it’s time to sign your loan contract. Afterward, Best Egg will send you a welcome email, which will include your account number and payment schedule.

Barring unforeseen circumstances, you should see your loan in your bank account in one to three business days.

How Best Egg compares to other personal loan companies

Even if you believe Best Egg aligns with what you’re looking for in a personal loan, it never hurts to shop around and compare other lenders. Here’s how Best Egg stacks up against similar personal loan lenders.

| Best Egg | Upstart | LightStream | |

|---|---|---|---|

| LendingTree’s rating | /5 | /5 | /5 |

| Minimum credit score | 580 | Not specified | |

| APRs | 6.99% – 35.99% | 7.23% – 24.00% | |

| Loan amounts | $2,000 to $5,000,000 | Not specified to $125,000,000 | |

| Repayment terms | 36 to 60 months | 12 to 84 months | [/generic-modal] |

| Origination fee | None | ||

| Funding timeline | Receive funds as soon as the next business day. | Receive funds as soon as the next business day. | Receive funds as soon as the same day you apply. |

| Bottom line | Best Egg has a high maximum APR, so it may be a better fit for those with excellent credit. And while every Best Egg loan has an origination fee, it may be worth it if you’re looking for flexible payments. | Upstart has one of the lowest minimum credit score requirements around. If you have bad credit, Upstart may be an option. However, you could be on the hook for an origination fee even higher than Best Egg ’s. | ’s rates tend to be more competitive than Best Egg ‘s. It also doesn’t charge any fees. However, with a minimum loan amount of , won’t make sense if you need a small loan. |

How we rated Best Egg

We evaluate personal loan lenders on more than just interest rates. Our goal is to show how accessible, affordable, transparent and supportive each lender really is.

Our categories

Every lender is scored out of 5 stars, with 5 stars being the highest rating. LendingTree loan experts determine this score using dozens of underlying data points across four weighted categories covering the full borrowing journey.

We assess how easy it is for people to qualify and apply. This includes state availability, soft-credit prequalification, membership requirements, funding speed and whether borrowers with less-than-excellent credit can get a loan.

We evaluate how affordable the loans are based on minimum and maximum APRs, loan fees and rate discounts. Lenders with unclear or potentially predatory costs receive lower scores.

We consider repayment term flexibility, loan amount ranges and whether options like secured loans, joint loans or direct-to-creditor payments are offered — plus whether the lender clearly communicates these options.

We evaluate borrower experience after funding: customer service access, hardship or forbearance programs, payment flexibility and digital tools like mobile apps or credit monitoring.

Our process

We gather data directly from lenders through their websites, disclosures and direct communication with company representatives. Our editorial team verifies and updates information regularly. We value transparency and award less favorable scores when lenders obscure or omit details.

In some cases, our editors may apply a small adjustment (no more than 4% of the overall score) to account for factors not captured by the methodology. This could include J.D. Power customer satisfaction surveys, recent regulatory actions or features that stand out in ways our rubric doesn’t measure directly.

Our editorial team applies the same scoring model and standards to every lender. Lenders cannot pay to influence our ratings.

Frequently asked questions

Yes, Best Egg is a legitimate online lender. Thousands of LendingTree users have left Best Egg personal loan reviews (and as of this writing, it’s earned 4.9 out of five stars).

You could qualify for a Best Egg personal loan with a credit score as low as 580. To get the best interest rate, you need at least a 700 score. You can check your credit score for free with LendingTree Spring.

Once you submit an application, Best Egg usually provides an approval decision in just a few minutes. If Best Egg approves you, you could have your funds as soon as the next business day (although some may need to wait up to three business days). Best Egg claims that about half of its borrowers get their loan the next business day.

Get personal loan offers from up to 5 lenders in minutes