Laurel Road Personal Loan Review

- APR

- 8.99% – 35.49%

The following payment example depicts the APR, monthly payment and total payments made during the life of a personal loan with a single disbursement. All loan rates below are shown with the autopay discount (0.25%) and direct deposit discount (0.25%). The monthly payment for a $30,000 loan with a 60-month term and a fixed annual percentage rate (APR) between 12.95% – 25.03% would be $681.82 – $881.07 in monthly payments, with total payments between $40,909.47 – $52,864.05. Your actual interest rate may be different than the loan interest rates in these examples and will be based on term of loan, your financial history, and other factors, including your cosigner’s (if any) financial history. Lowest rates reserved for the most creditworthy borrowers. See SoFi.com/eligibility for details. Fixed rates from 8.99% APR to 29.99% APR reflect the 0.25% autopay interest rate discount and a 0.25% direct deposit interest rate discount. SoFi rate ranges are current as of 02/06/2024 and are subject to change without notice. The average of SoFi Personal Loans funded in 2022 was around $30K. Not all applicants qualify for the lowest rate. Lowest rates reserved for the most creditworthy borrowers. Your actual rate will be within the range of rates listed and will depend on the term you select, evaluation of your creditworthiness, income, and a variety of other factors. Loan amounts range from $5,000- $100,000. The APR is the cost of credit as a yearly rate and reflects both your interest rate and an origination fee of 0%-7%, which will be deducted from any loan proceeds you receive. Autopay: The SoFi 0.25% autopay interest rate reduction requires you to agree to make monthly principal and interest payments by an automatic monthly deduction from a savings or checking account. The benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. Autopay is not required to receive a loan from SoFi. Direct Deposit Discount: To be eligible to potentially receive an additional (0.25%) interest rate reduction for setting up direct deposit with a SoFi Checking and Savings account offered by SoFi Bank, N.A. or eligible cash management account offered by SoFi Securities, LLC (“Direct Deposit Account”), you must have an open Direct Deposit Account within 30 days of the funding of your Loan. Once eligible, you will receive this discount during periods in which you have enabled payroll direct deposits of at least $1,000/month to a Direct Deposit Account in accordance with SoFi’s reasonable procedures and requirements to be determined at SoFi’s sole discretion. This discount will be lost during periods in which SoFi determines you have turned off direct deposits to your Direct Deposit Account. You are not required to enroll in direct deposits to receive a Loan.

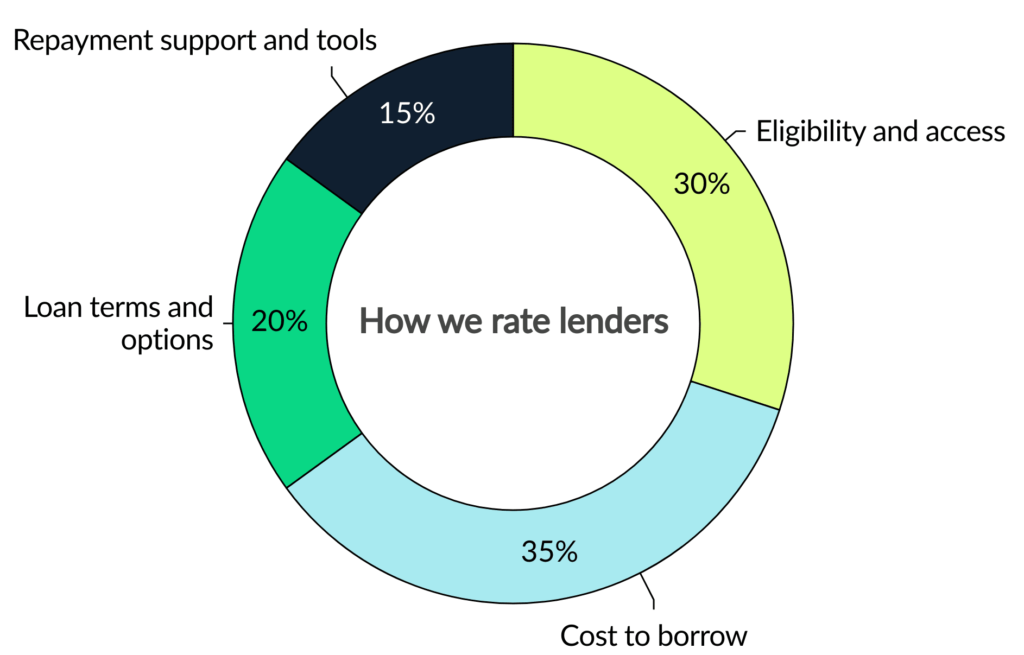

- Eligibility and access: 3/5

- Cost to borrow: 5/5

- Loan terms and options: 4.6/5

- Repayment support and tools: 5/5

- SoFi offers a variety of loan and banking products, including personal loans.

- Low APRs: SoFi offers competitive interest rates on its personal loans, but you may need good credit to qualify.

- Autopay discount: By setting up automatic payments from a checking account, you could earn a 0.25% discount on your APR and save some money over the lifetime of the loan.

- Smaller loan size: The most you can borrow for debt consolidation, major purchases or home improvements is $100,000. The maximum for auto purchases or moving expenses is $35,000.

- Fewer term options: SoFi only lets you choose from terms of 24 months, 48 months or 84 months. Other lenders have shorter and longer loan terms available.

- Unclear eligibility criteria: SoFi ’s website doesn’t provide much detail on what you need to qualify. For example, it doesn’t specify a minimum credit score or other criteria. However, you can check your eligibility with SoFi using a soft credit check that won’t hurt your credit score.

- Best for borrowers who prequalify and shop for rates: SoFi lets you check conditional terms without a hard credit check so you can shop around for the best APR at no risk.

SoFi pros and cons

SoFi ’s loan terms may differ based on how you plan to use the money, but you can use the loan for many purposes. Here’s what else you should consider before you take out a loan with SoFi :

Pros

- Rates are competitive

- Fast funding timeline after approval

- No origination fees or other hidden costs

Cons

- SoFi doesn’t disclose eligibility criteria

- May only be available to borrowers with good credit

- Can borrow more money from other lenders

Depending on your financial needs, SoFi might have great terms: Its rates start at 8.99%, and there are no origination fees. Once you’re approved for a loan with SoFi , you’ll get your funds in about 24 hours.

But, if you need a bigger loan or don’t have a strong credit history, you might not be able to get funding. SoFi only lends up to $100,000 ($35,000 for certain expenses), and by offering lower rates, the lender will be more selective about who it approves.

Depending on your existing debt, income and credit score, you may not be eligible. However, you can check your rates without impacting your credit.

SoFi requirements

While loan eligibility will depend on factors such as your financial health and credit history, SoFi doesn’t specify a minimum income or credit score. SoFi loans also may not be used for educational expenses, though the lender offers specialized loan products for physicians, dentists and those in training.

| Laurel Road loans CAN be used for… | Laurel Road loans CANNOT be used for… |

|---|---|

|

|

If SoFi ’s loan options won’t work for your borrowing needs, shop around for a lender that helps you meet your financial goals and can offer you the best-fitting rates, terms and amounts.

How to get a personal loan with SoFi

Prequalify for a loan

You’ll provide basic information, including your employment history, and authorize a soft credit pull to receive conditional interest rates on a possible loan.

Verify your information

After prequalification, you must upload some supporting documents and finish your application. You’ll take a hard credit check, and SoFi will give you specific loan rates and terms.

Sign for your loan

You can choose your loan, then e-sign any disclosures and the promissory note. If your loan is approved, it will likely be funded within seven business days. SoFi will transfer your money to you which can take about 24 hours after approval.

If you’re unable to get approval for a personal loan, SoFi allows cosigners on its loan applications — a cosigner with great credit can boost your chances of approval.

How SoFi compares to other personal loan companies

Even though SoFi has competitive terms, you should compare other lenders and find the best rates. Here’s how SoFi stacks up against similar lenders.

| SoFi | Discover | ||

|---|---|---|---|

| LendingTree’s rating | 3.4/5 | /5 | /5 |

| Minimum credit score | Not specified | Not specified | |

| APRs | 8.99% – 35.49%(with autopay) | 7.99% – 24.99% | (with autopay) |

| Loan amounts | $5,000 to $100,000 | $2,500 to $40,000 | |

| Repayment terms | 24 to 84 months | 36 to 84 months | months |

| Origination fee | None | None | None |

| Funding timeline | Most loans funded in around seven business days, but you can get money as soon as the next day | Get money as soon as the next day | Get money as soon as the same day |

| Bottom line | SoFi has competitive rates and doesn’t charge origination fees. But competitors Discover and LightStream offer lower starting rates and longer repayment terms. | If you’re looking for a small loan, Discover lets you borrow as little as $2,500. That said, you’ll need good credit to qualify. | has a wide range of loan terms and the lowest starting rates. It’s a good fit for borrowers who need fast funding and a large loan. |

How we rated SoFi

We evaluate personal loan lenders on more than just interest rates. Our goal is to show how accessible, affordable, transparent and supportive each lender really is.

Our categories

Every lender is scored out of 5 stars, with 5 stars being the highest rating. LendingTree loan experts determine this score using dozens of underlying data points across four weighted categories covering the full borrowing journey.

We assess how easy it is for people to qualify and apply. This includes state availability, soft-credit prequalification, membership requirements, funding speed and whether borrowers with less-than-excellent credit can get a loan.

We evaluate how affordable the loans are based on minimum and maximum APRs, loan fees and rate discounts. Lenders with unclear or potentially predatory costs receive lower scores.

We consider repayment term flexibility, loan amount ranges and whether options like secured loans, joint loans or direct-to-creditor payments are offered — plus whether the lender clearly communicates these options.

We evaluate borrower experience after funding: customer service access, hardship or forbearance programs, payment flexibility and digital tools like mobile apps or credit monitoring.

Our process

We gather data directly from lenders through their websites, disclosures and direct communication with company representatives. Our editorial team verifies and updates information regularly. We value transparency and award less favorable scores when lenders obscure or omit details.

In some cases, our editors may apply a small adjustment (no more than 4% of the overall score) to account for factors not captured by the methodology. This could include J.D. Power customer satisfaction surveys, recent regulatory actions or features that stand out in ways our rubric doesn’t measure directly.

Our editorial team applies the same scoring model and standards to every lender. Lenders cannot pay to influence our ratings.

Frequently asked questions

No, Laurel Road doesn’t charge origination fees for personal loans.

Yes, doctors and residents may be able to borrow higher amounts and for different terms than other people with Laurel Road personal loans.

It can take Laurel Road around seven days to approve and fund your loan. Once your loan is approved, Laurel Road will deposit your funds in about 24 hours.

Get personal loan offers from up to 5 lenders in minutes