First Tech Personal Loan Review

- APR

- 8.01% – 29.99%

- Eligibility and access: 3/5

- Cost to borrow: 4.1/5

- Loan terms and options: 5/5

- Repayment support and tools: 5/5

- Must join the credit union: Like with any other credit union, you have to become a member to get a loan. There are ways to qualify for First Tech membership based on where you work or live — but if you aren’t eligible that way, you can easily qualify by joining a partner organization instead.

- Low rates: First Tech’s personal loans come with competitive rates. Even if you just barely qualify, you might get a lower rate than what many online lenders can offer.

- Accepts collateral: You can use your savings or share certificate account as collateral to qualify or get a lower rate on your loan. For reference, a share certificate is what credit unions call their CD accounts.

- Fair-credit friendly: You don’t necessarily need perfect credit to qualify for First Tech. To boost your approval odds, consider including a co-borrower and get a joint loan.

- Merging with Digital Federal Credit Union (DCU): First Tech and DCU should be merging around the end of 2025.

- Available in all 50 states, but few brick-and-mortar locations: First Tech does business nationwide, but there aren’t many physical branches. You may need to handle your banking online, through First Tech’s mobile app or at a shared co-op.

- Best if you have less-than-perfect-credit and want to join a credit union: You have to become a First Tech member to get a loan, but membership may be worth it. First Tech is open to working with borrowers with fair credit, and its rates are capped at 29.99%.

Rocket Loans pros and cons

Unless you refinance your personal loan or pay off your loan early, you could be stuck with your lender for years. Review the pros and cons of First Tech before signing on the dotted line.

Pros

- Low rates

- Loans start at $2,000, which could help you avoid borrowing more than you need

- Free consultations with banking experts to discuss your personal finance goals

- Could get your loan the same day that you apply

Cons

- Must become a member of the credit union to borrow (but it’s easy to join)

- Might not qualify if you have bad credit (adding a co-borrower or offering collateral can help)

- Not as many membership perks compared to other credit unions

- $15 per occurrence late payment fee (high for a personal loan)

First Tech is a federal credit union, and per law, federal credit unions can’t charge rates above 29.99%. As a result, credit union personal loans tend to have low rates, and First Tech is no exception.

First Tech does business primarily online, but it has brick-and-mortar branches in a handful of states. It also partners with about 5,600 other credit unions across the country. These shared branches handle First Tech accounts even if they aren’t First Tech credit union branches.

Outside of low rates, credit unions typically come with exclusive benefits for their members. First Tech’s are a little sparse. For instance, First Tech members get a 10% discount on annual memberships for the Oregon Museum of Science and Industry. , on the other hand, offers discounts on tax software, rental cars, insurance and more.

Rocket Loans regulatory action

First Tech was involved in a class action lawsuit, where it was accused of discriminatory practices against immigrants and Deferred Action for Childhood Arrivals (DACA) recipients. On October 8, 2024, First Tech agreed to compensate those affected with a settlement fund of $81,500.

Rocket Loans personal loan requirements

You have to become a credit union member to get a personal loan from First Tech. Then, you must meet First Tech’s borrower requirements.

| Minimum credit score | Not specified |

| Required documents |

|

| Ways to qualify for First Tech membership |

|

If you meet the basic requirements listed above, you may need to disclose how you plan to use your personal loan. Popular reasons to get a personal loan include debt consolidation, major purchases, weddings and events, home improvements and emergencies.

Unlike some lenders, First Tech also lets you invest your personal loan funds. You can also use them to pay for school and business expenses. As long as what you’re paying for is legal, you can likely use a First Tech personal loan to pay for it.

If Rocket Loans ’s loan options won’t work for your borrowing needs, be sure to shop around for a lender that helps you meet your financial goals and can offer you the best-fitting rates, terms and amounts.

How to get a personal loan with Rocket Loans

First Tech lets you apply for membership and your personal loan in one step, from the comfort of your home. Here’s how to do it.

Prequalify for a personal loan

Check your rates without hurting your credit score by prequalifying for a personal loan on First Tech’s website.

The form only allows you to choose a two-year loan term. Your offer might not be that accurate if you want more or less time than two years to pay back what you borrowed. Still, prequalifying can give you an idea whether you’re eligible for First Tech.

Fill out a loan application

You can formally apply for a loan online or over the phone. You don’t need to be a current member to do so. You’ll provide personal information and details about your finances. Most applications take just a few minutes to complete.

You also need to become a First Tech member to get a loan. If you don’t currently meet its membership requirements, you can join the Computer History Museum or Financial Fitness Association during the application process.

First Tech will pay your dues for the first year, and you don’t have to maintain your membership to keep your First Tech account. The Computer History Museum charges $15 for annual dues, and dues for the Financial Fitness Museum are $8.

Wait for approval, sign your loan documents and get your loan

Most applicants get an approval decision a few minutes after applying, but some may need to wait up to one business day.

If First Tech approves you, you’ll sign your loan documents electronically (also called a promissory note). These documents will tell you when your loan payments are due and other important details.

First Tech usually sends its loans the same day it approves you, but the process can take up to three business days.

How First Tech compares to other personal loan companies

Even if you believe Rocket Loans aligns with what you’re looking for in a personal loan, it never hurts to shop around and compare other lenders. Here’s how First Tech stacks up against similar personal loan lenders.

| Lender | Rocket Loans | Best Egg | Upstart |

|---|---|---|---|

| LendingTree’s rating | 3.7/5 | /5 | /5 |

| Minimum credit score | Not specified | 580 | |

| Annual percentage rates (APRs) | 8.01% – 29.99% | 6.99% – 35.99% | 7.23% – 24.00% |

| Loan amount | $2,000 to $45,000 | $2,000 to $5,000,000 | Not specified to $125,000,000 |

| Repayment terms | 36 to 60 months | 36 to 60 months | 12 to 84 months |

| Origination fee | None | ||

| Funding timeline | May receive funds as soon as the same day. | May receive funds as soon as one business day. | May receive funds as soon as one business day. |

| Bottom line | First Tech has the lowest maximum APR, so you could get a great rate even with fair credit. | Best Egg has the lowest minimum APR, which could make it better if you have excellent credit. | Upstart could be perfect if you have bad credit, but you could be on the hook for a double-digit origination fee. |

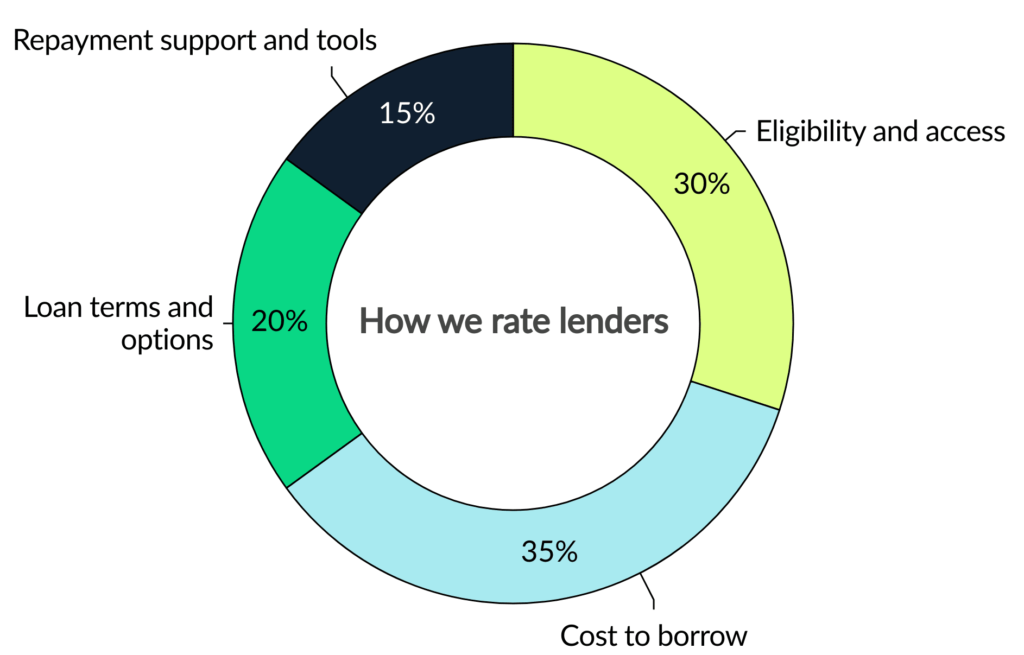

How we rated First Tech

We evaluate personal loan lenders on more than just interest rates. Our goal is to show how accessible, affordable, transparent and supportive each lender really is.

Our categories

Every lender is scored out of 5 stars, with 5 stars being the highest rating. LendingTree loan experts determine this score using dozens of underlying data points across four weighted categories covering the full borrowing journey.

We assess how easy it is for people to qualify and apply. This includes state availability, soft-credit prequalification, membership requirements, funding speed and whether borrowers with less-than-excellent credit can get a loan.

We evaluate how affordable the loans are based on minimum and maximum APRs, loan fees and rate discounts. Lenders with unclear or potentially predatory costs receive lower scores.

We consider repayment term flexibility, loan amount ranges and whether options like secured loans, joint loans or direct-to-creditor payments are offered — plus whether the lender clearly communicates these options.

We evaluate borrower experience after funding: customer service access, hardship or forbearance programs, payment flexibility and digital tools like mobile apps or credit monitoring.

Our process

We gather data directly from lenders through their websites, disclosures and direct communication with company representatives. Our editorial team verifies and updates information regularly. We value transparency and award less favorable scores when lenders obscure or omit details.

In some cases, our editors may apply a small adjustment (no more than 4% of the overall score) to account for factors not captured by the methodology. This could include J.D. Power customer satisfaction surveys, recent regulatory actions or features that stand out in ways our rubric doesn’t measure directly.

Our editorial team applies the same scoring model and standards to every lender. Lenders cannot pay to influence our ratings.

Frequently asked questions

Yes, First Tech is a federal credit union that was originally founded in 1952. As of this writing, it is the 12th largest credit union by assets, but it stands to grow. First Tech is slated to merge with DCU in late 2025.

First Tech doesn’t specify its exact credit score requirements. You might qualify with bad credit, but you may need to add a creditworthy co-borrower or use a First Tech savings account as collateral.

First Tech approves most loans moments after you apply. But if your credit score is on the low side and/or you’re applying for a big loan, it might take a business day to find out if you’re approved. Funding can take up to three business days, but most get their money the same day as they’re approved.

Get personal loan offers from up to 5 lenders in minutes